Unlimited Blog

We are experienced investors using machine learning to create products that replicate the index returns of alternative investments.

2Q 2024 Hedge Fund Barometer

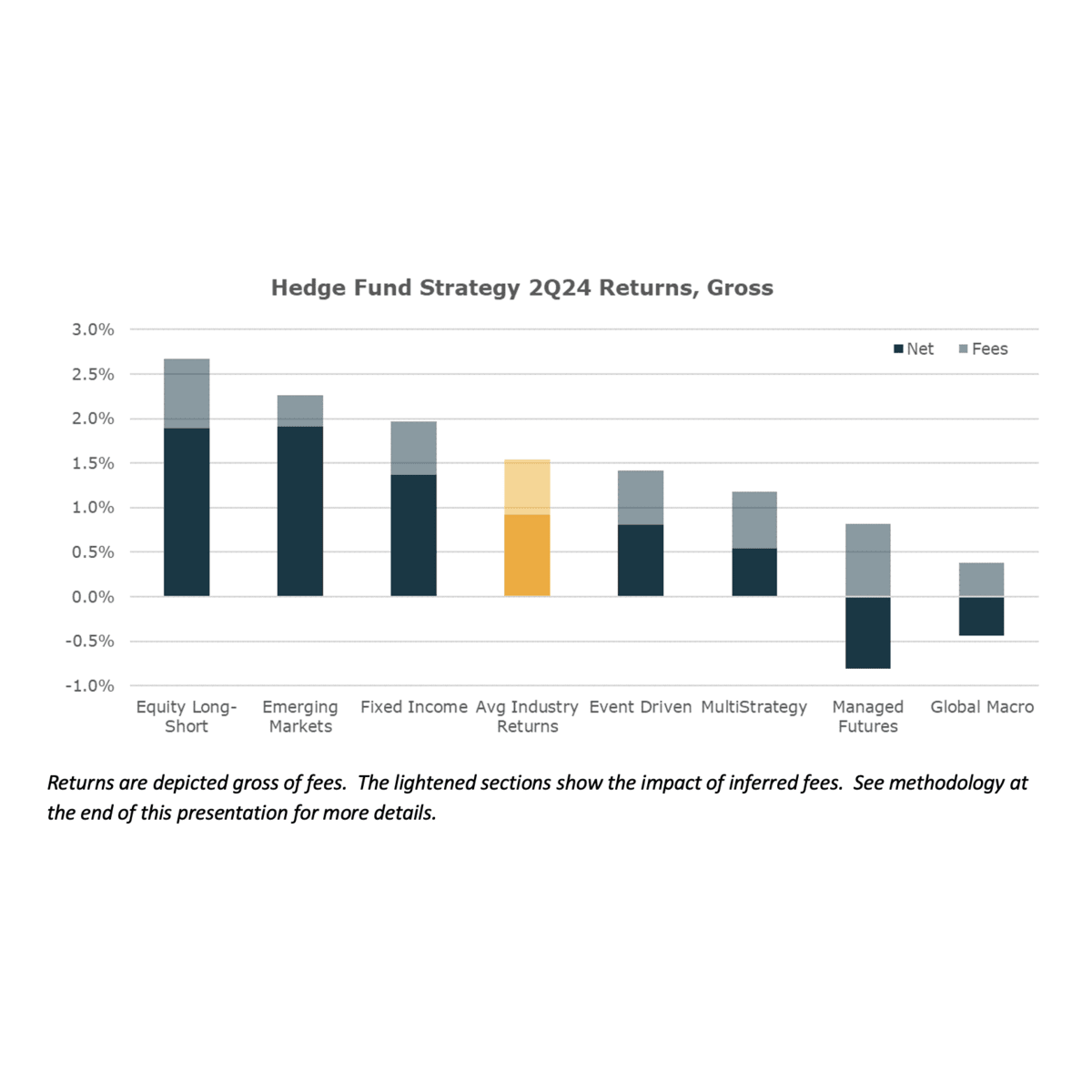

Hedge Fund performance in the second quarter was modestly positive across most hedge fund strategies, with Managed Futures and Global Macro managers notably delivering weak returns as market and economic trends oscillated quickly from March to April to May.

Top Posts

What’s Under the Hood? What Matters for ETF Liquidity

Understanding the liquidity of an individual stock, bond, or futures contract is…

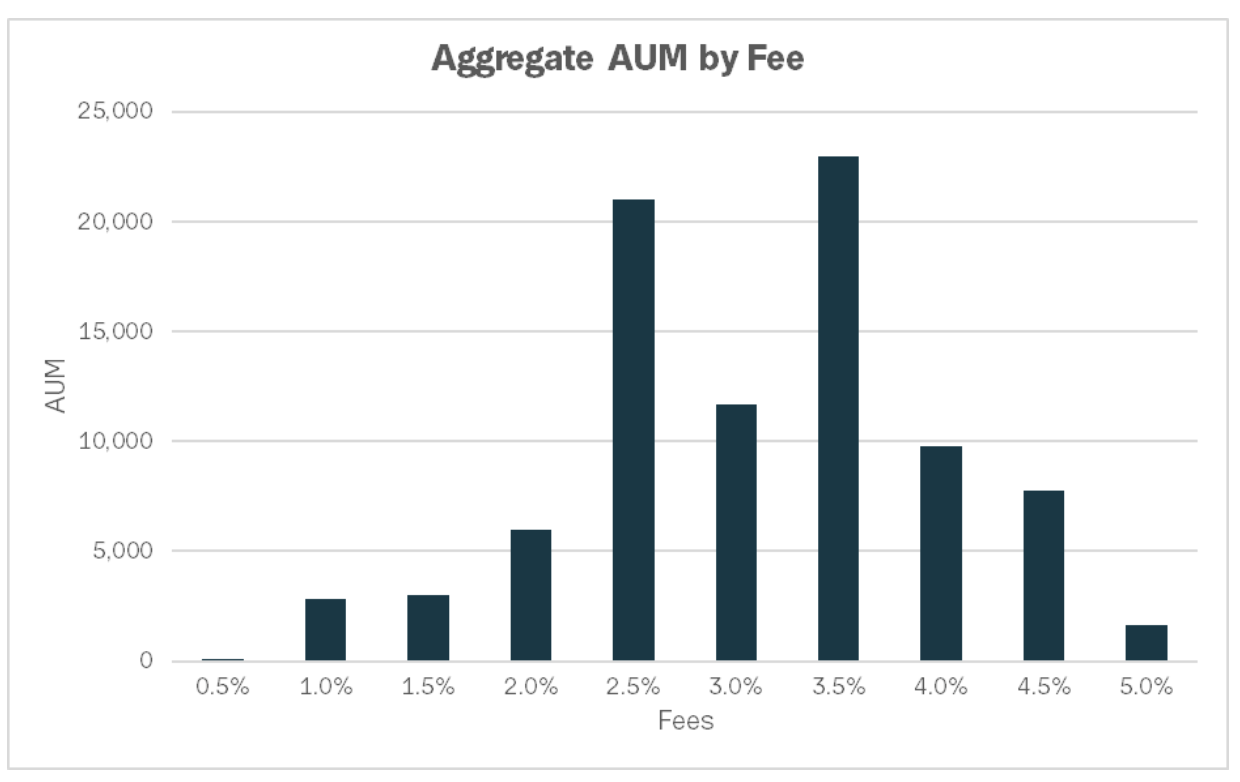

The Fees Are Too Damned High for Most Liquid Alts

Liquid alternatives products often offer the allure of returns that could benefit most…

Hedge Funds Stay Defensive As Equities Creep Higher

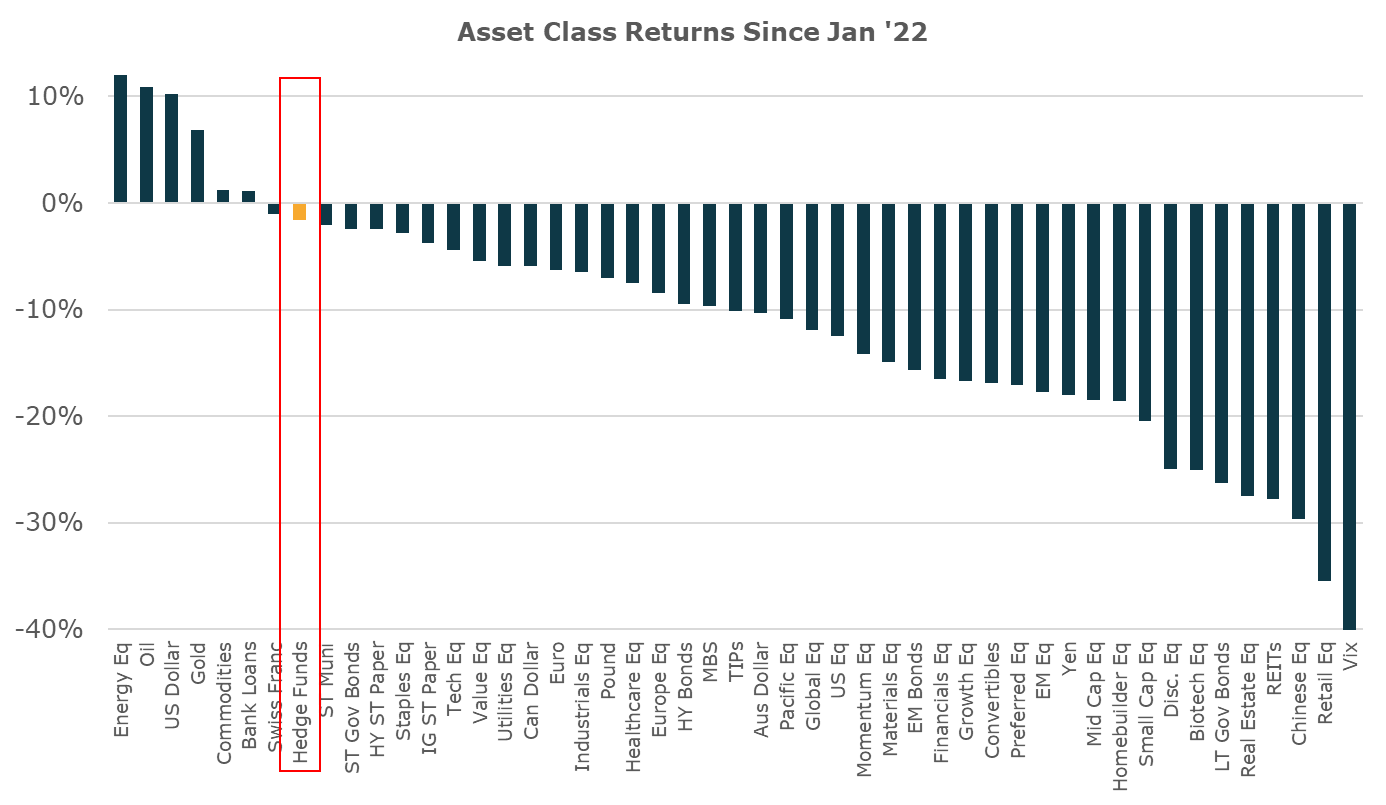

It’s been a difficult year for the Hedge Fund industry, generating mid single digit returns in an environment of very strong equity performance

Hedge Funds Cautiously Tilt Higher For Longer

The Silicon Valley Bank failure and subsequent deflationary credit crunch market dynamics created significant pain for many hedge funds…

Imperfect Replication Beats Single Manager Selection 9/10 Times

One of the commonly raised concerns about Hedge Fund replication strategies is the tracking…

Hedge Funds, What Have You Done for Me Lately? A Lot.

Hedge Funds are roughly flat in ‘23 while a broad market cap weighted index of US stocks has…

Stocks Need Easy Money to Consistently Outperform Hedge Funds

Stock indexes have outperformed hedge funds by quite a bit this year. As of late May, the NASDAQ is…

Hedge Funds Positioning For A Wide Range Of Possible Outcomes

The current macro environment presents some of the most uncertain circumstances that we have…

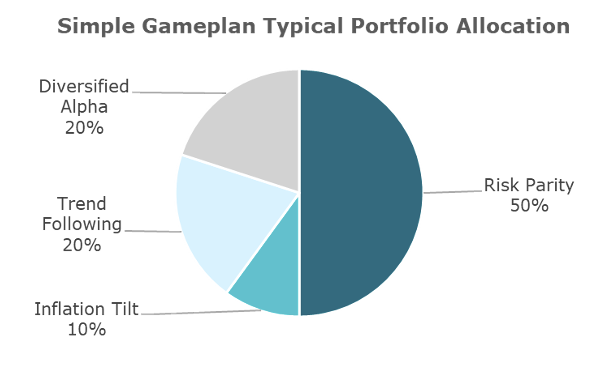

A Simple Investment Gameplan

The last year has all of us wrestling with whether our investment gameplan will work in a wide…