Unlimited Blog

We are experienced investors using machine learning to create products that replicate the index returns of alternative investments.

2Q 2024 Hedge Fund Barometer

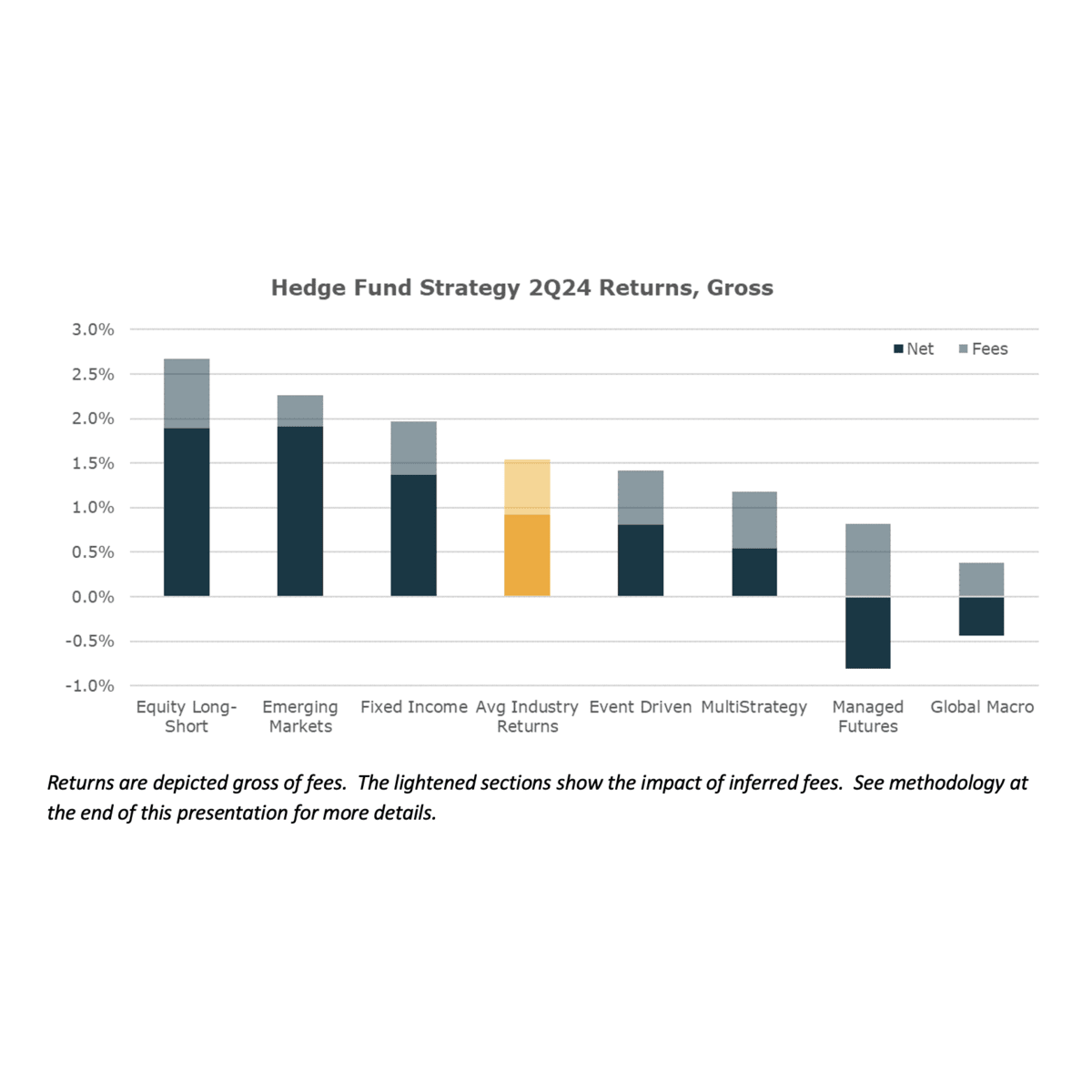

Hedge Fund performance in the second quarter was modestly positive across most hedge fund strategies, with Managed Futures and Global Macro managers notably delivering weak returns as market and economic trends oscillated quickly from March to April to May.

Top Posts

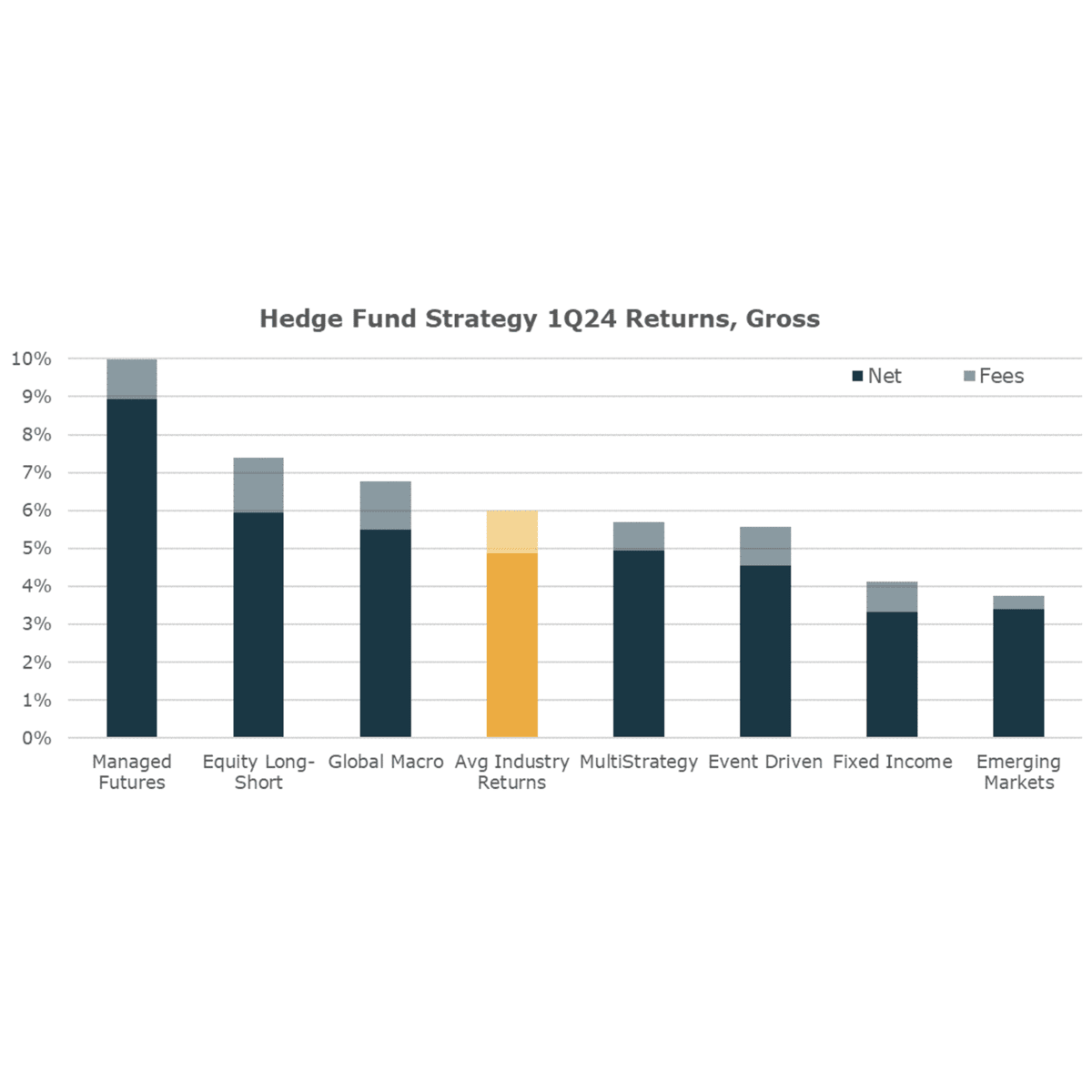

1Q 2024 Unlimited Hedge Fund Barometer

Hedge Fund performance in the first quarter was the best in more than 3 years, driven by an unusual combination of…

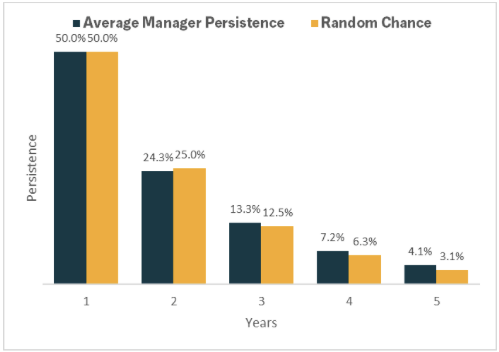

The Best Skill or the Most Luck?

One of the hardest things to do in investment management is figure out if outcomes are a function of luck or skill…

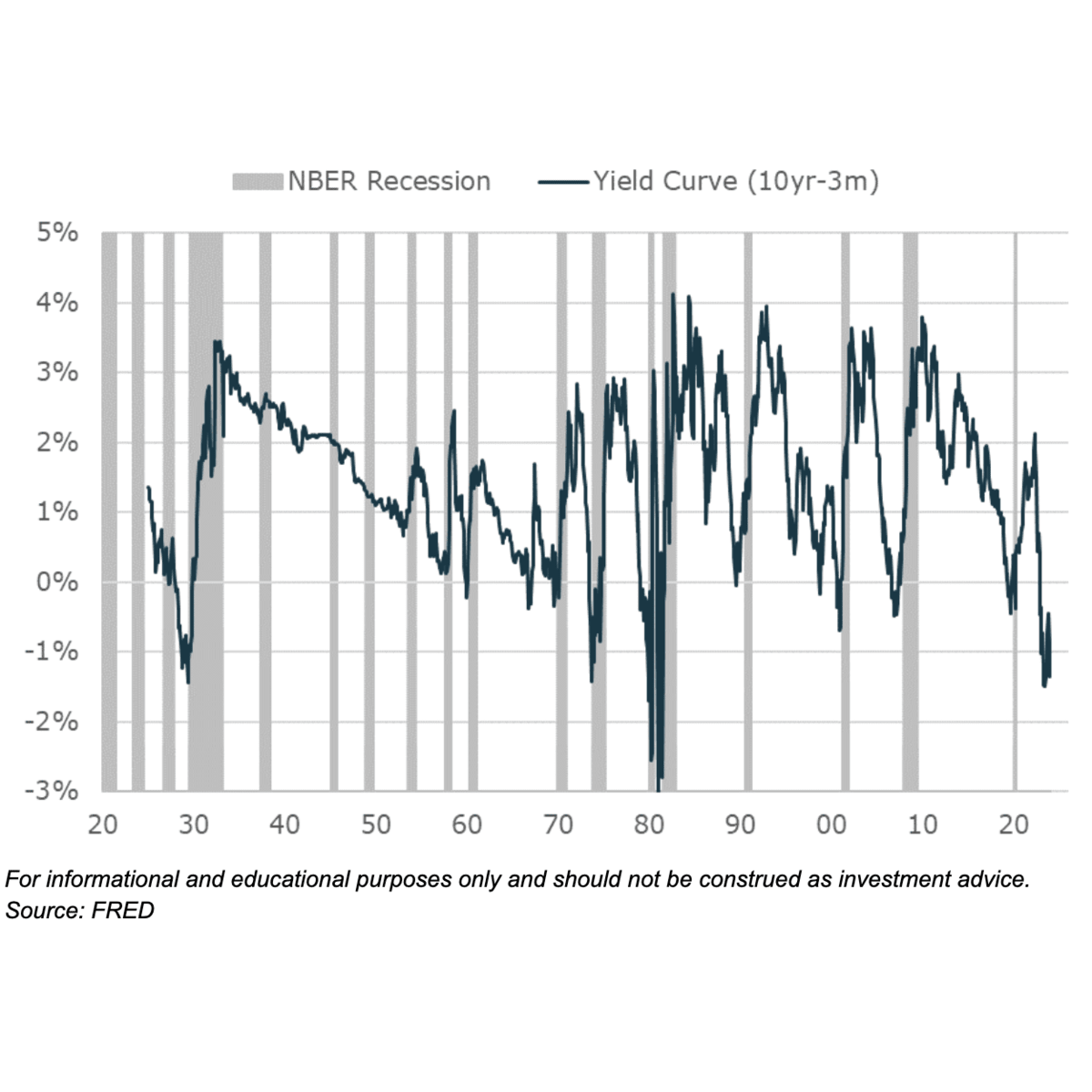

Far From Perfect: Inverted Yield Curves Don’t Reliably Predict Recessions or the Direction of the Markets

On October 25, 2022 the yield curve flipped to inverted and has remained so for the nearly 500 days since…

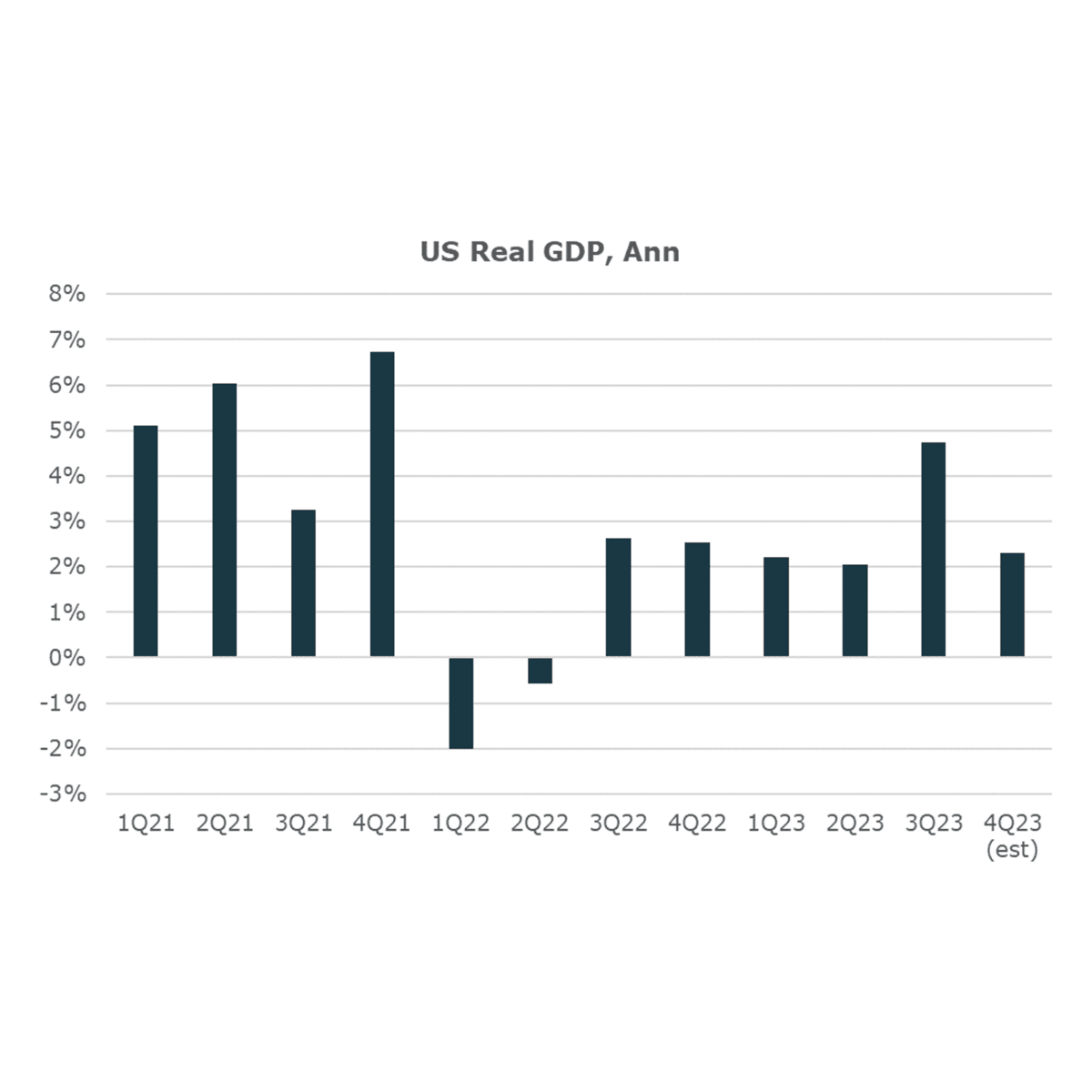

The Outlook 2024: Stronger for Longer

Despite prognostications and market pricing of a near certain recession at the start of 2023, the US economy not only avoided a downturn, it thrived…

Not All-in on US Mega Cap Stocks? That’s Prudent, But Currently Underperforming

US stocks outperformance of pretty much everything returned again in 2023…

Is The U.S. Economy in a Recession?

Published by Bruce McNevin on Nov 27, 2023 With conflicting macroeconomic indicators and diverging expert opinions, we reviewed the National Bureau of Economic Research (NBER) recession indicators

Where To Turn When Stocks and Bonds Move Together

Historically, 60/40 investors have relied on bonds to protect their equity positions and preserve capital through market down-turns…

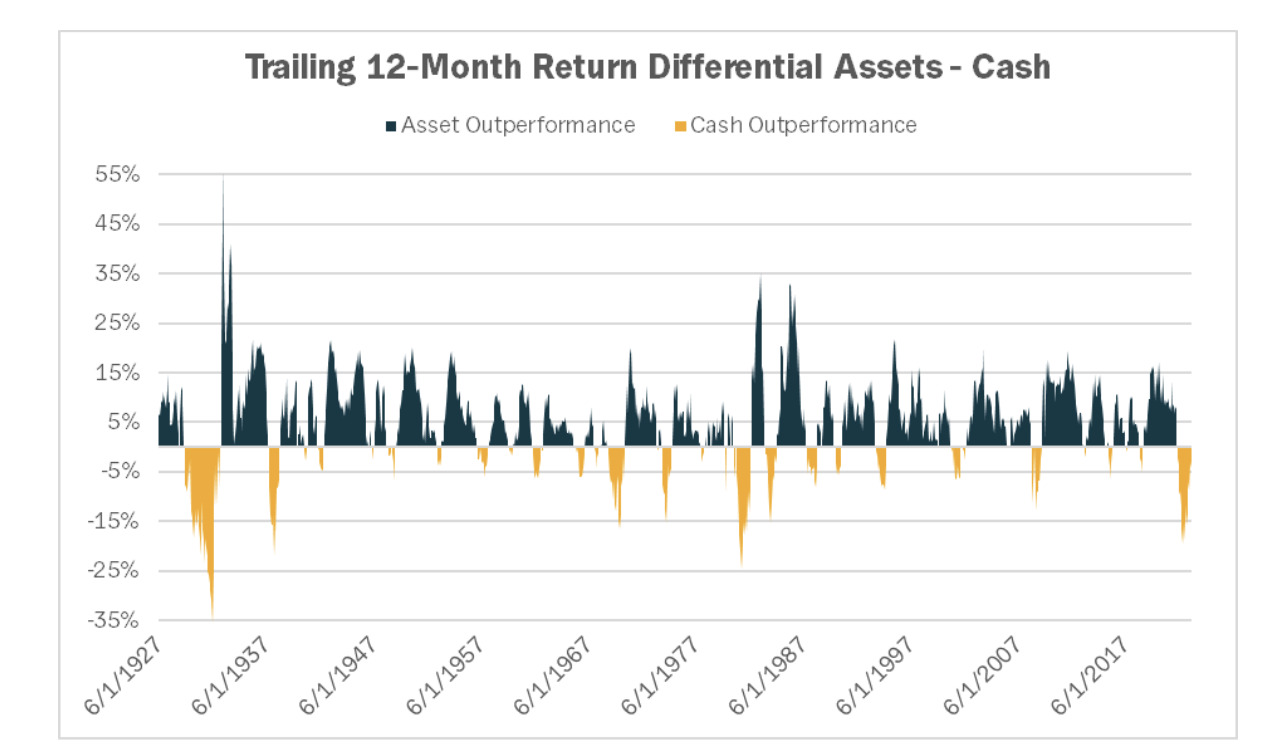

Don’t Overweight Cash Unless You’re a Market-Timing Genius

Effectively timing the market requires extreme skill. Fortunately, diversification allows…

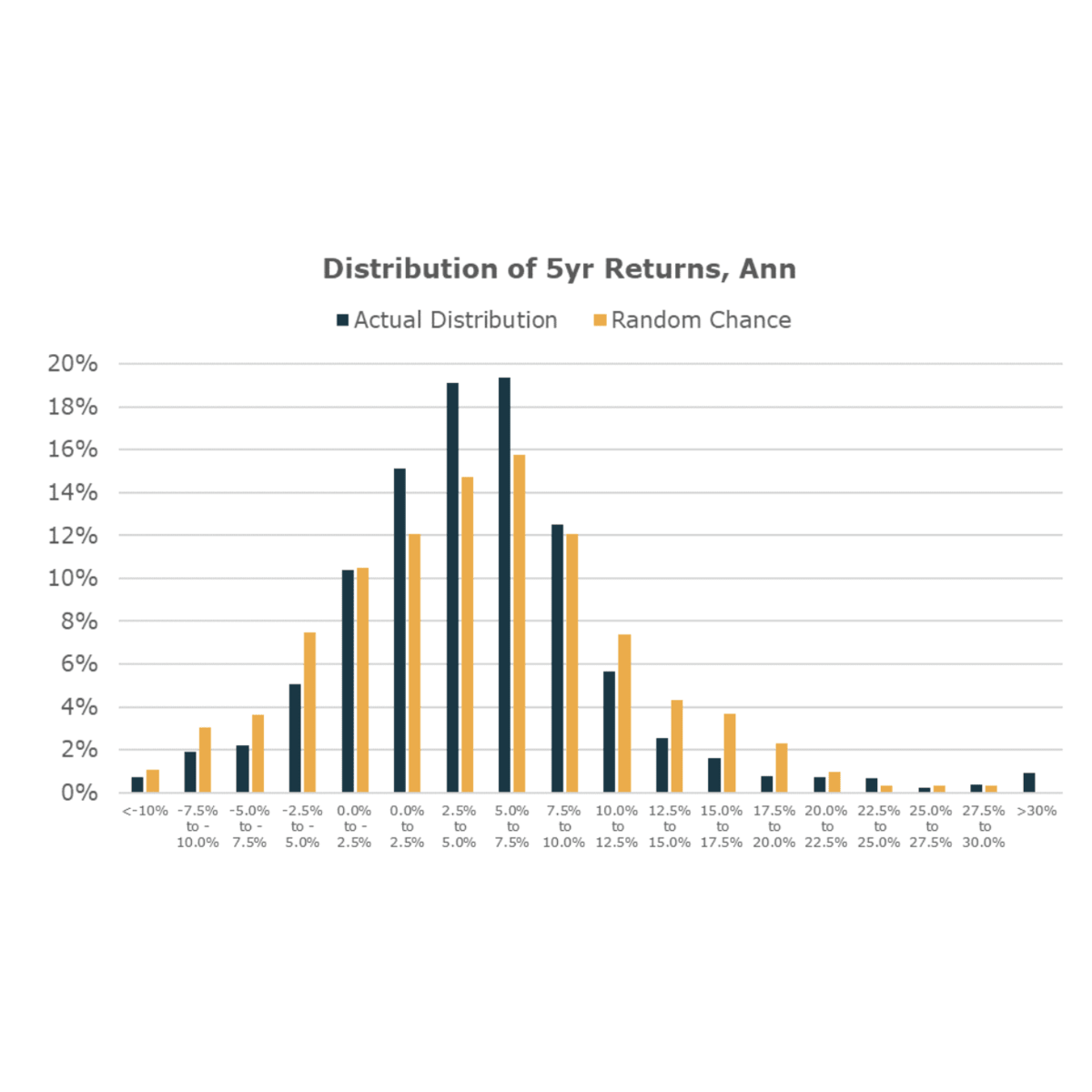

Who Is Better: Hedge Fund Allocators or Dart-Throwing Monkeys?

Every hedge fund allocator dreams of finding the portfolio of managers that reliably outperforms…