Unlimited Blog

We are experienced investors using machine learning to create products that replicate the index returns of alternative investments.

2Q 2024 Hedge Fund Barometer

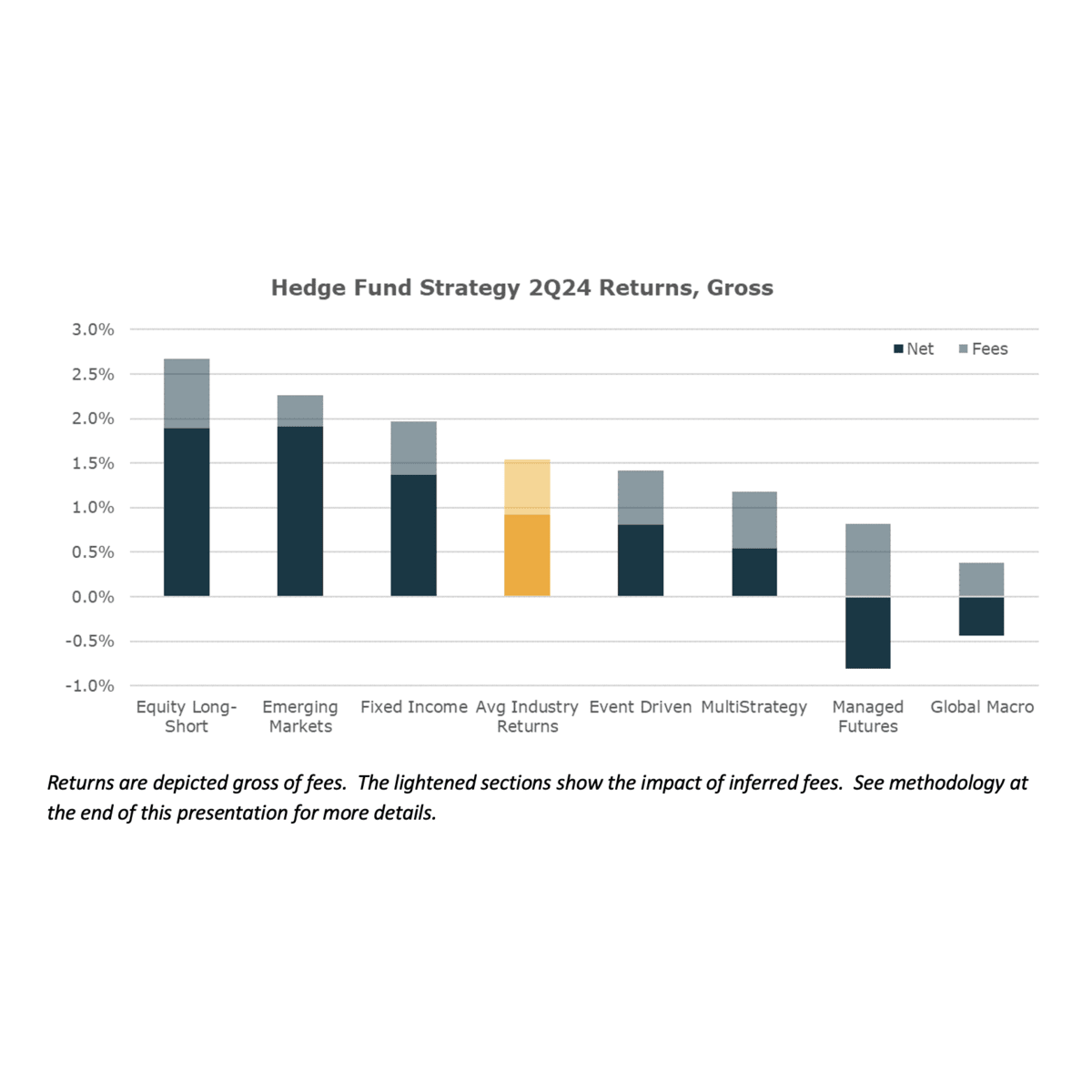

Hedge Fund performance in the second quarter was modestly positive across most hedge fund strategies, with Managed Futures and Global Macro managers notably delivering weak returns as market and economic trends oscillated quickly from March to April to May.

Top Posts

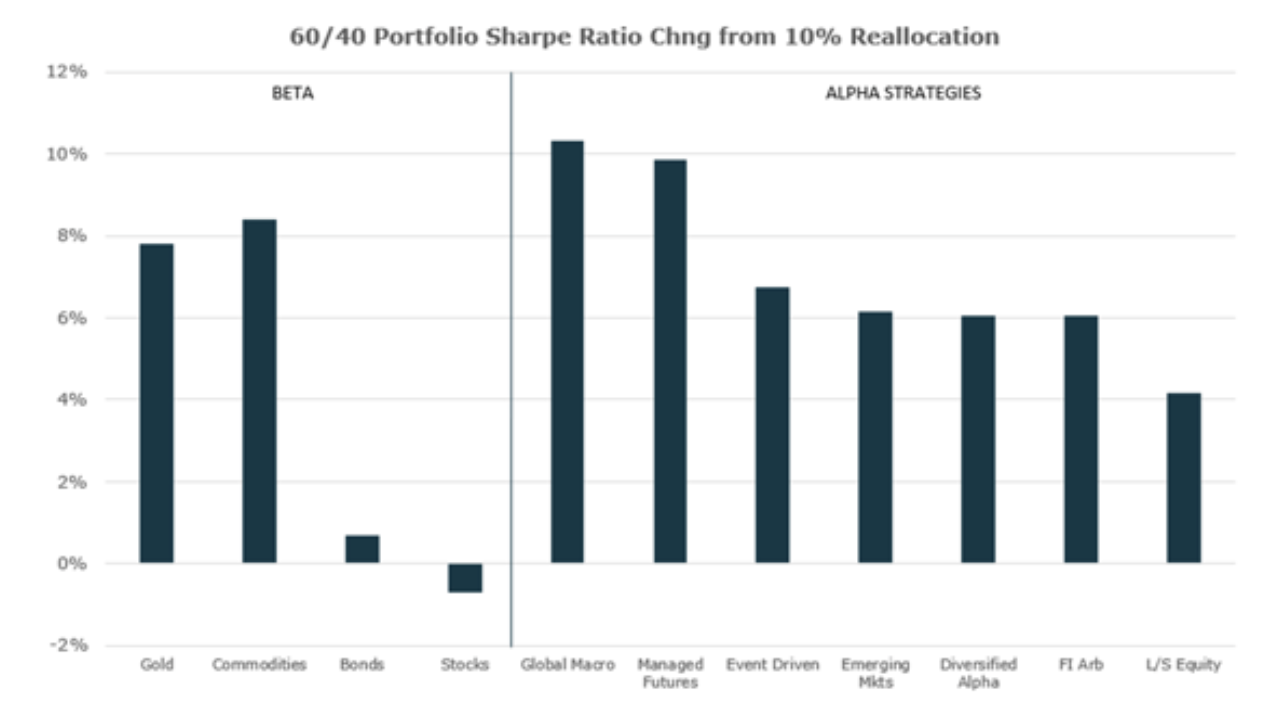

A Prime Opportunity To Improve Diversification

2022 was a difficult year for most investors and advisors. The one silver lining is that this…

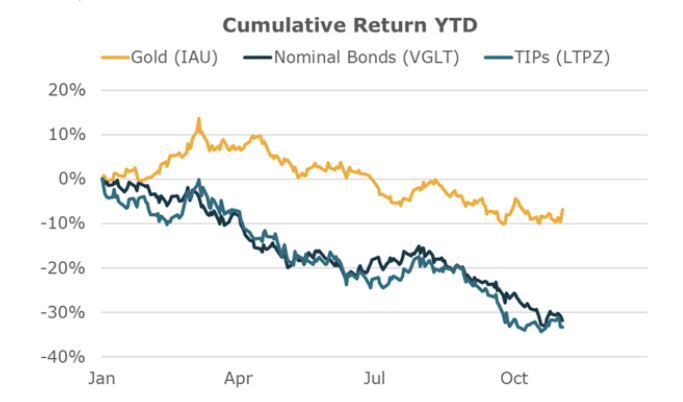

Hedge Funds Are Effectively Playing Defense

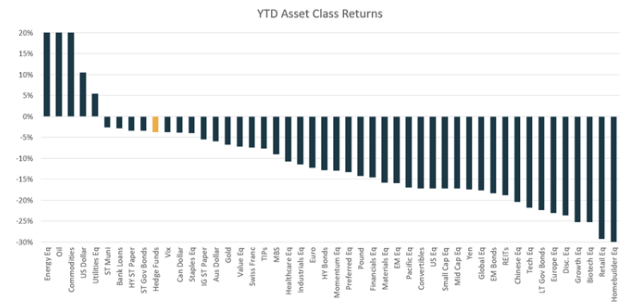

It’s been a tough year for all investors as nearly all passive asset investments have lost money except for concentrated commodity positions.

Is the U.S. Economy in a Recession? No.

Considering the widespread speculation that the economy is in a recession, we thought it might be…

The Role of Gold In a Portfolio

Gold is a unique financial asset. It is best thought of as a non-interest bearing real asset…

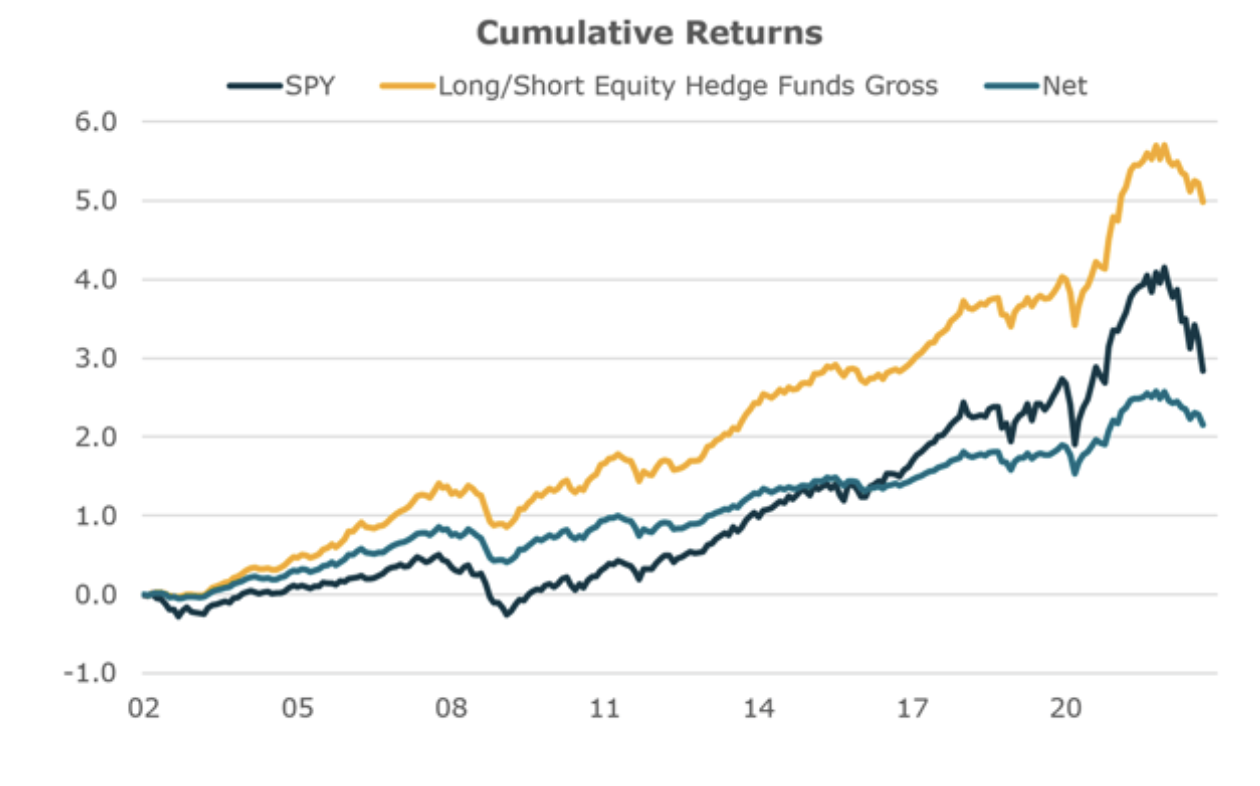

L/S Equity Has A Fee Problem, Not a Performance Problem

Long Short Equity hedge funds have taken a lot of heat in the press recently. After years of…

Hedge Funds Are Doing Pretty Well This Year

Diversified alpha allocations should deliver pretty good returns (on par with the S&P 500) with…

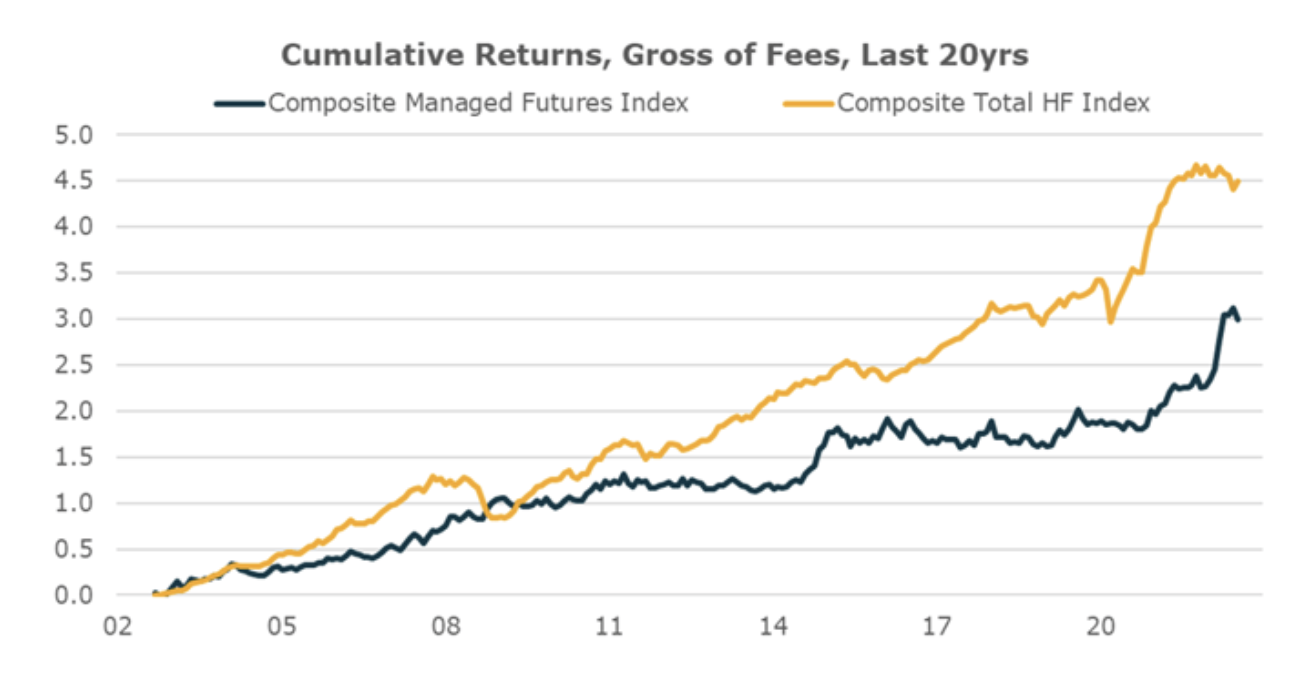

Managed Futures Have Been Good, Diversified Alpha Will Be Better

Managed Futures managers’ strong performance this year is reviving the sector after nearly…

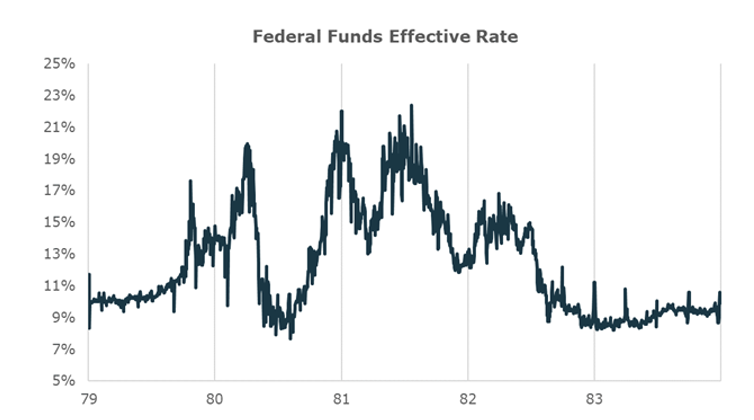

Lessons From Volcker’s Inflation Fight

All eyes are on Chairman Powell’s speech this week for his thoughts on how he will tackle today’s…

Diversified Alpha is Better Than Constrained Beta

Investors are always looking for a way to reduce their risk while preserving upside. That’s why..