Unlimited Blog

We are experienced investors using machine learning to create products that replicate the index returns of alternative investments.

1Q 2025 Unlimited Funds Hedge Fund Barometer

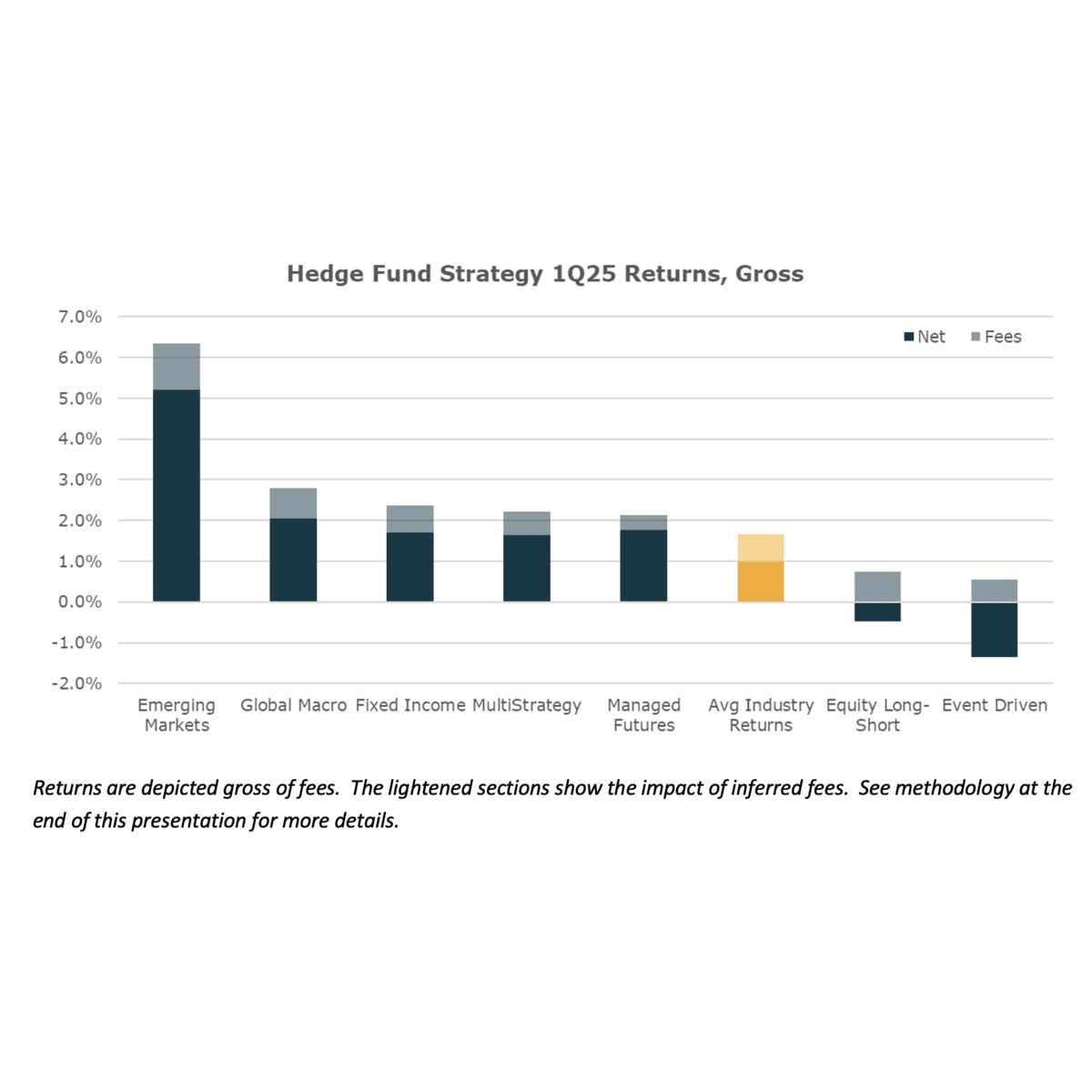

Hedge Funds eked out modestly positive performance in 1Q25 with the mix of sub-strategy returns largely reversing the moves of the previous quarter. Emerging Market funds outperformed meaningfully as Chinese stocks surged, meanwhile Equity Long/Short and Event Driven delivered weak outcomes.

Top Posts

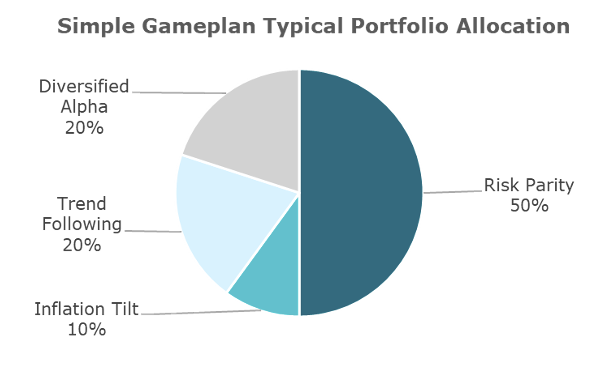

A Simple Investment Gameplan

The last year has all of us wrestling with whether our investment gameplan will work in a wide…

A Couple of Tough Weeks For Hedge Funds

Hedge Funds have experienced some of their worst performance ever over the last couple weeks. Our best estimate of March performance has the industry down roughly 3%, with most of that loss being booked in the last week.

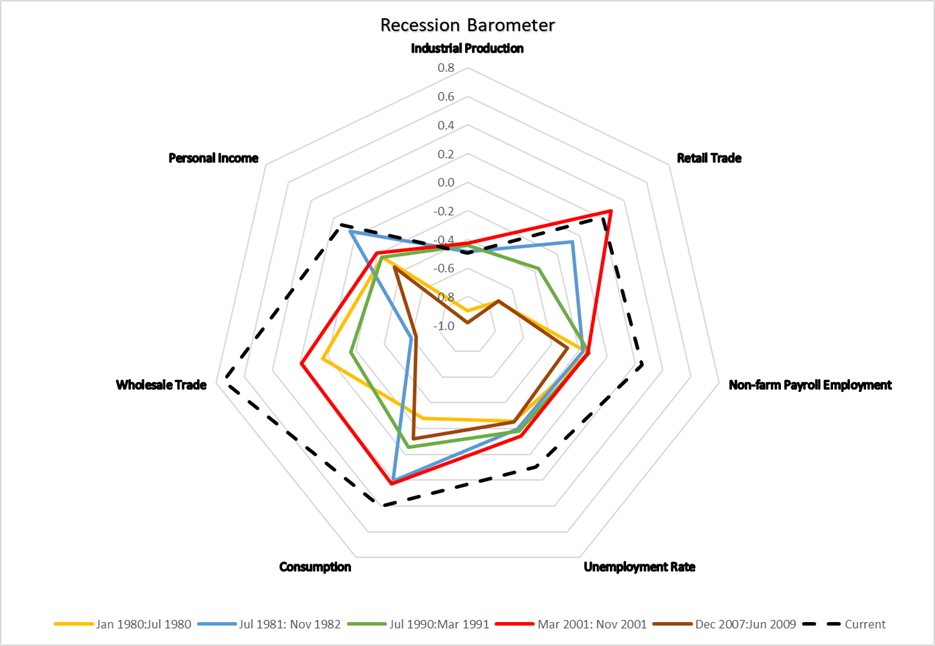

The Recession is Farther Away Than It Was 3 Months Ago

Three months ago, there was widespread speculation from many commentators that the US economy was…

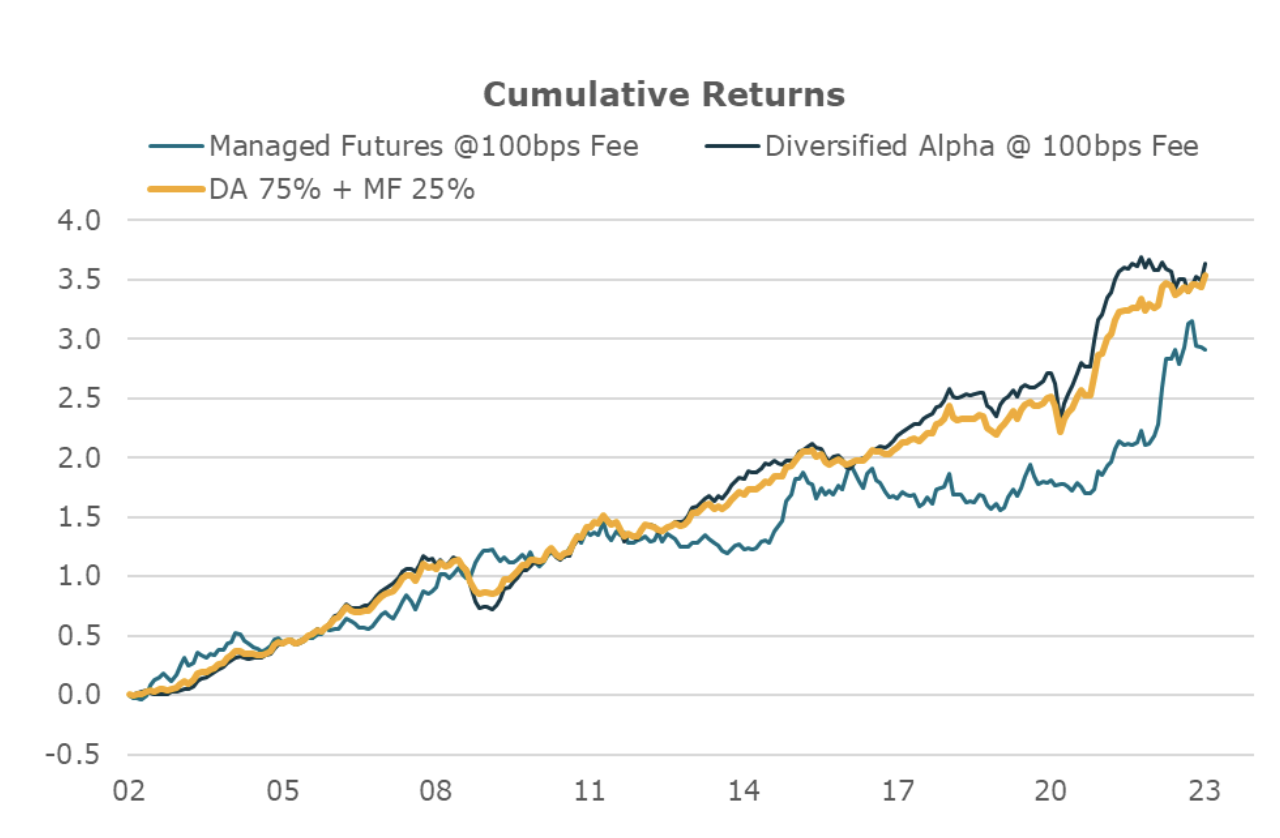

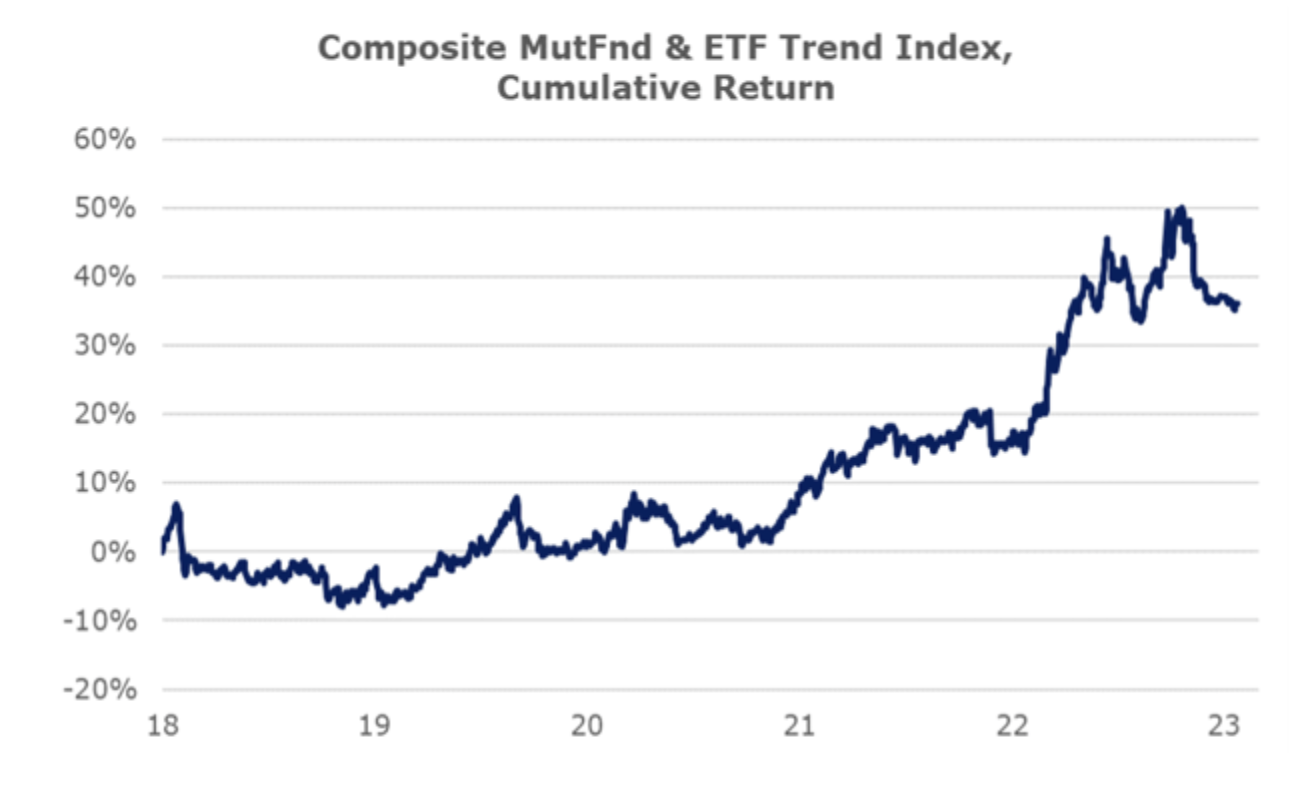

Pairing Managed Futures With Diversified Alpha For More Consistent Return

Many investors are looking at managed futures as an attractive complement for their portfolios…

Improving the Odds With Diversification

Alpha strategies are intended to provide a differentiated return stream from stocks and bonds…

The Trend Following Disappointment

Interest in trend-following strategies had a resurgence last summer as both bonds and stocks fell…

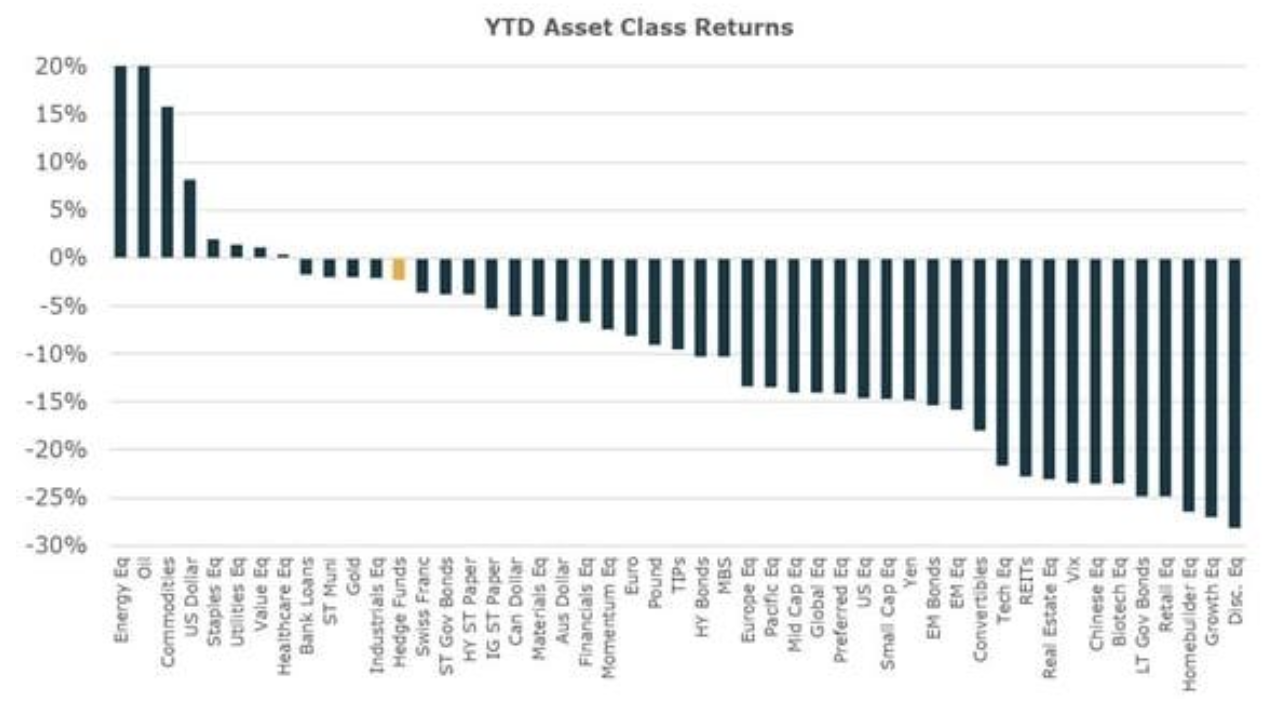

Hedge Funds Look To Smaller Companies and Credit, Short Tech

Hedge funds navigated the difficult 2022 market environment by maintaining low risk and conservative positioning across assets.

Transitory Goldilocks?

Unlimited’s perspectives on what the first part of 2023 will bring for the economy, its path from…

Hedge Funds Cautiously Looking For Opportunities Entering 2023

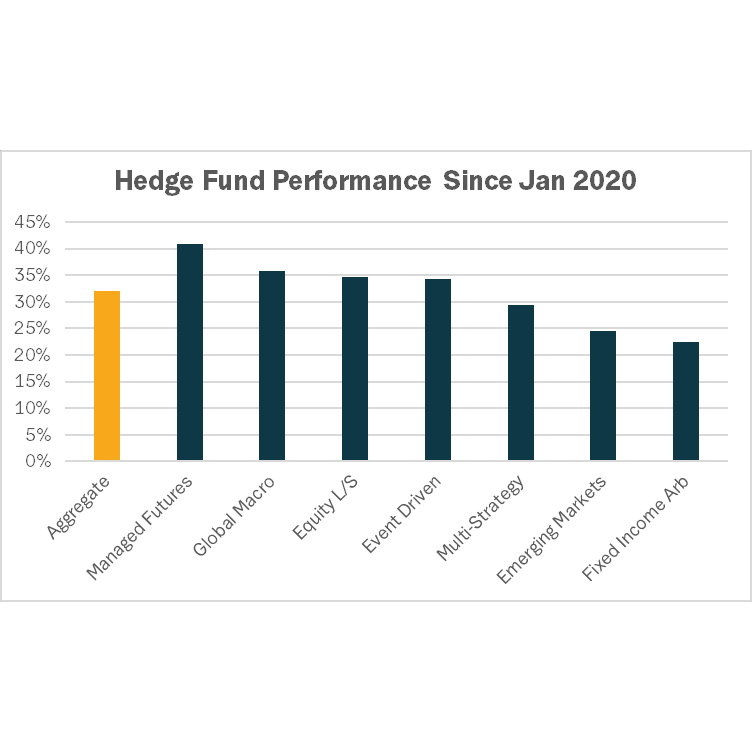

The Hedge Fund industry has navigated the most challenging market environment in decades pretty…