Unlimited Blog

We are experienced investors using machine learning to create products that replicate the index returns of alternative investments.

1Q 2025 Unlimited Funds Hedge Fund Barometer

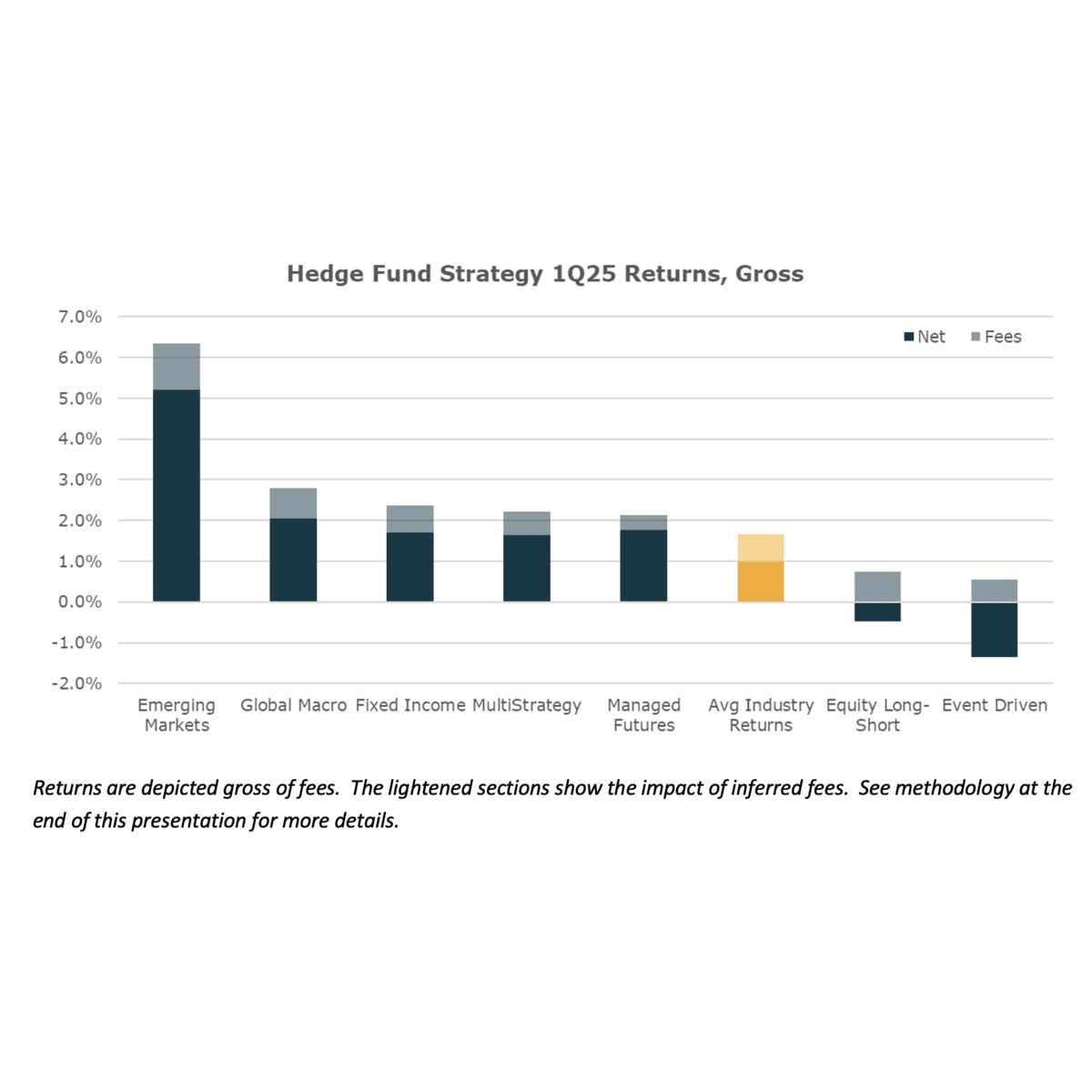

Hedge Funds eked out modestly positive performance in 1Q25 with the mix of sub-strategy returns largely reversing the moves of the previous quarter. Emerging Market funds outperformed meaningfully as Chinese stocks surged, meanwhile Equity Long/Short and Event Driven delivered weak outcomes.

Top Posts

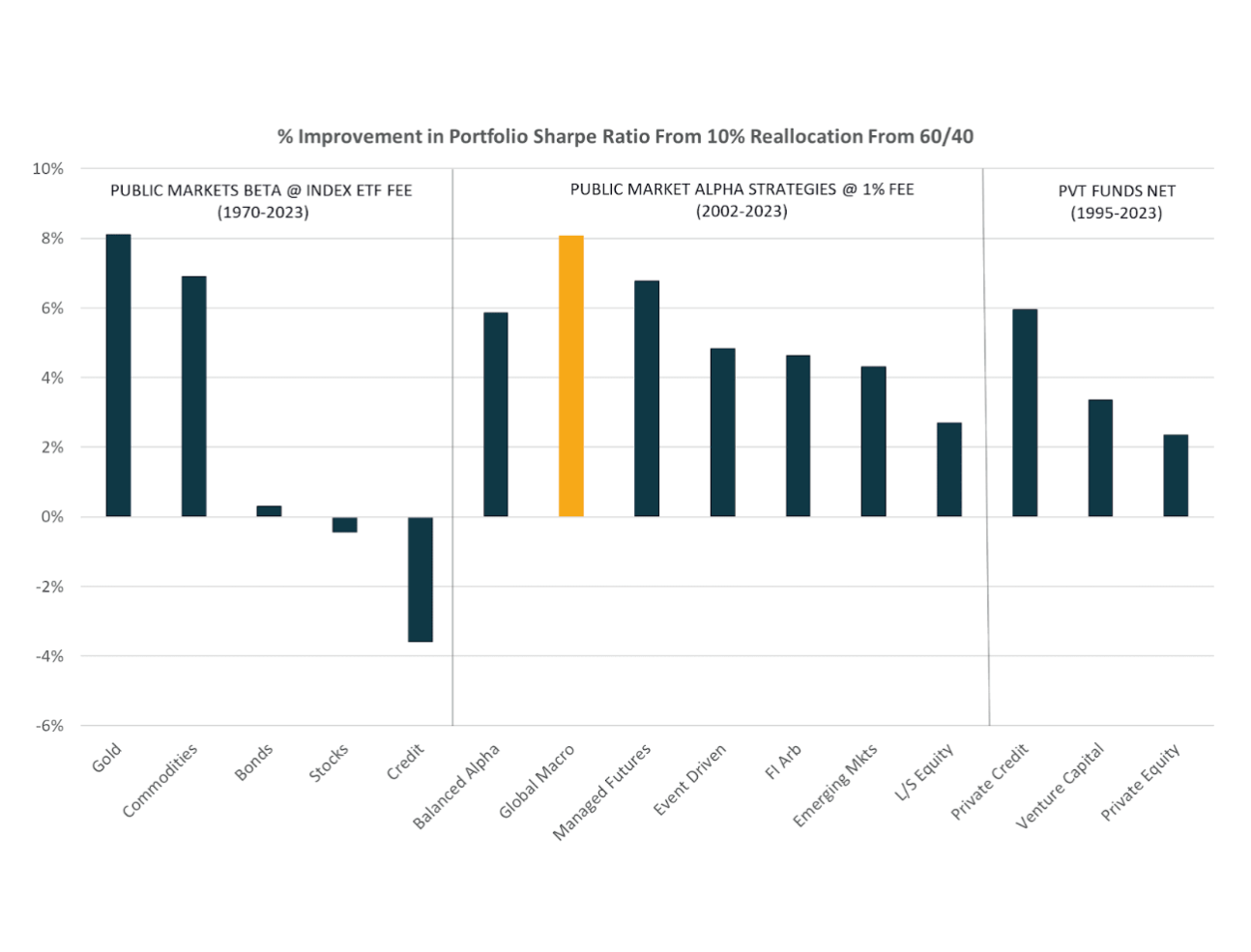

Considering The Benefits of Global Macro Alpha

The market turmoil to kick off ‘25 has many investors considering adding diversifying strategies to those traditional 60/40 portfolios that have done well in recent years. As we scan the universe of under appreciated diversifying strategies, Global Macro alpha stands out as one of the most compelling complements for many portfolios.

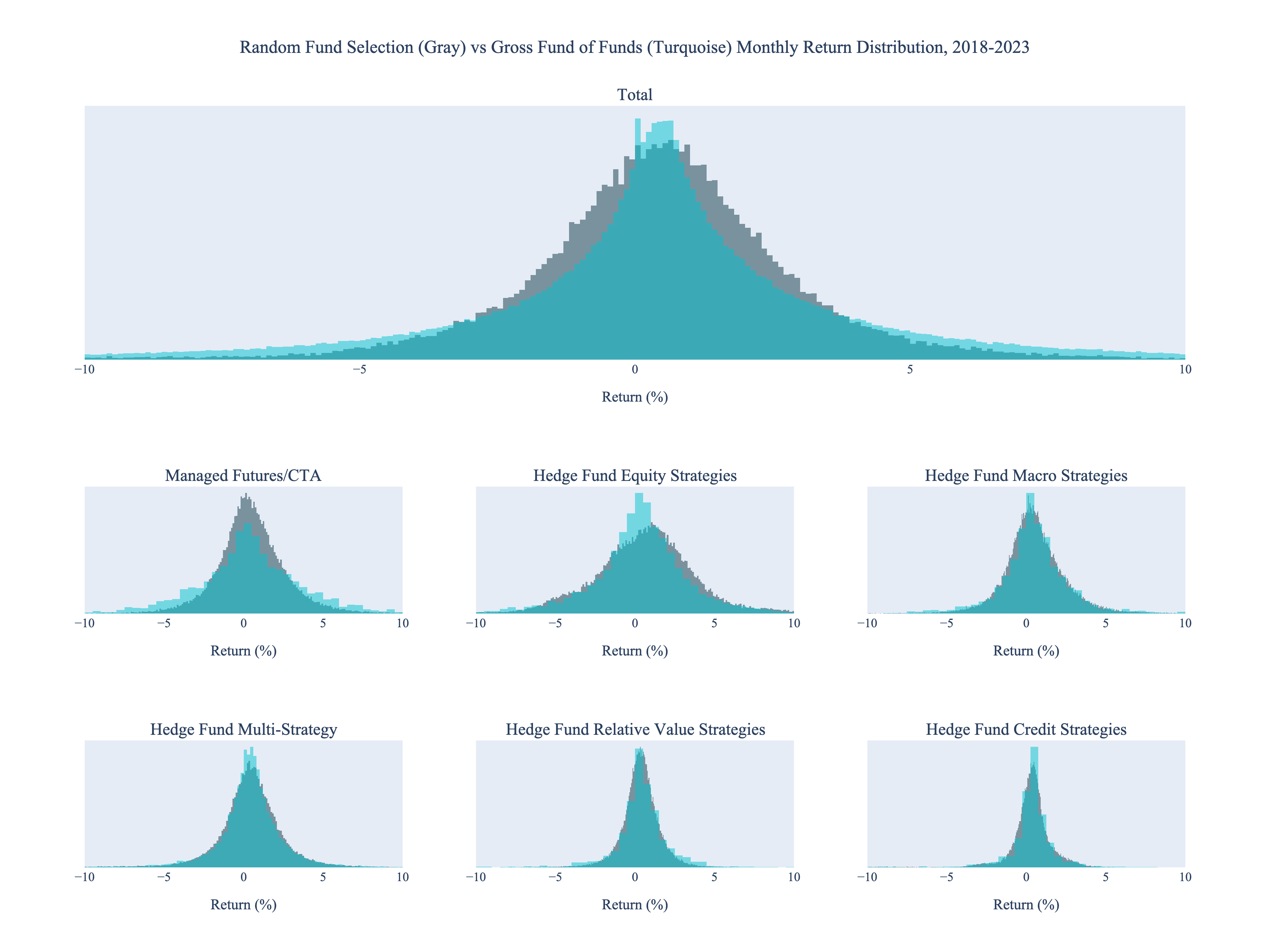

Perspectives on Portfolio Randomness and Asset Allocation

Active allocation strategies struggle to outperform a randomly selected portfolio of funds on a long-term basis. The data indicates that in pursuit of outperformance allocators may even be making riskier decisions.

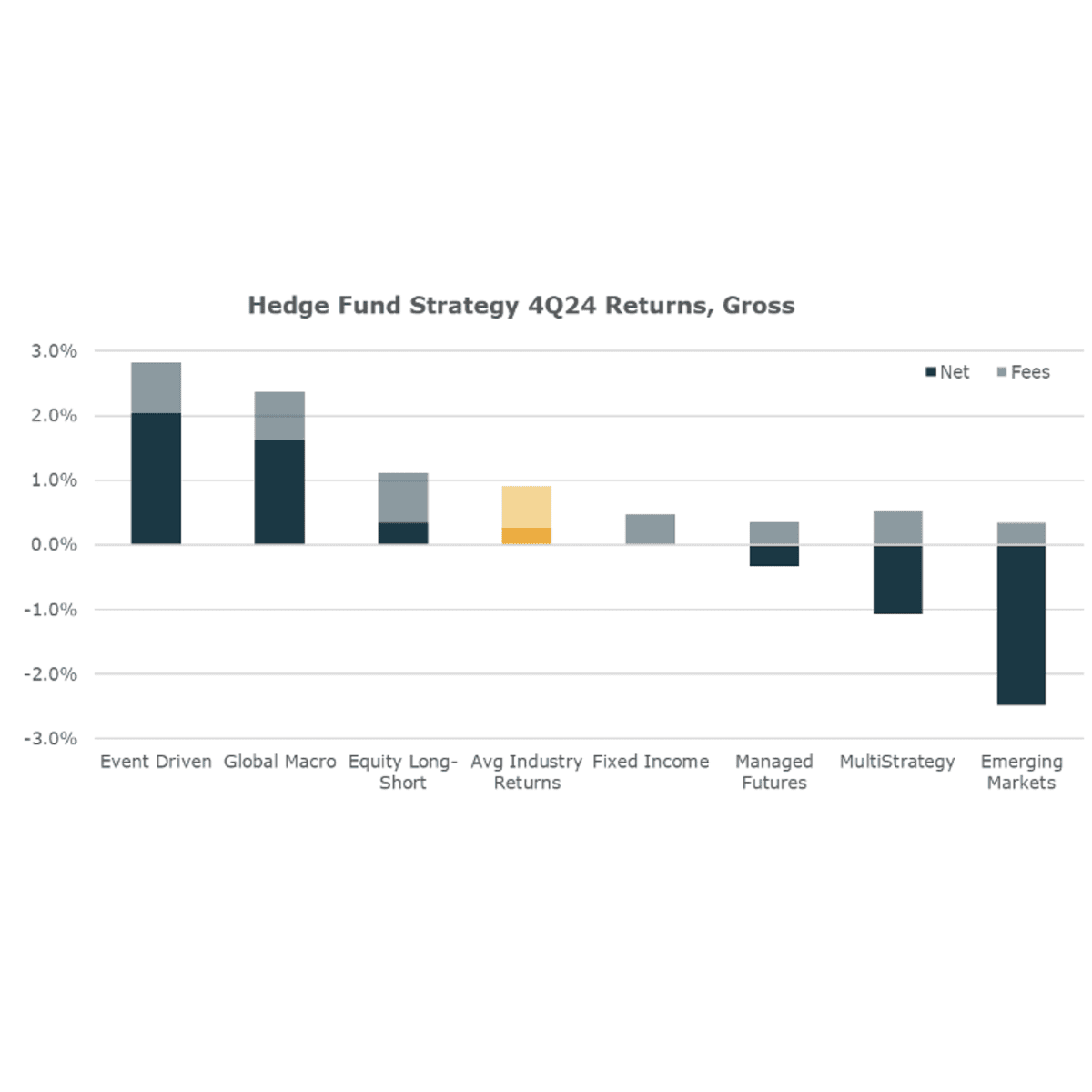

4Q 2024 Unlimited Hedge Fund Barometer

4Q 24 Hedge Fund Strategy Performance, Gross of Fees Summary Commentary Hedge Fund performance in 4Q24 was modestly positive with many Event Driven and Global

Curb Your Enthusiasm

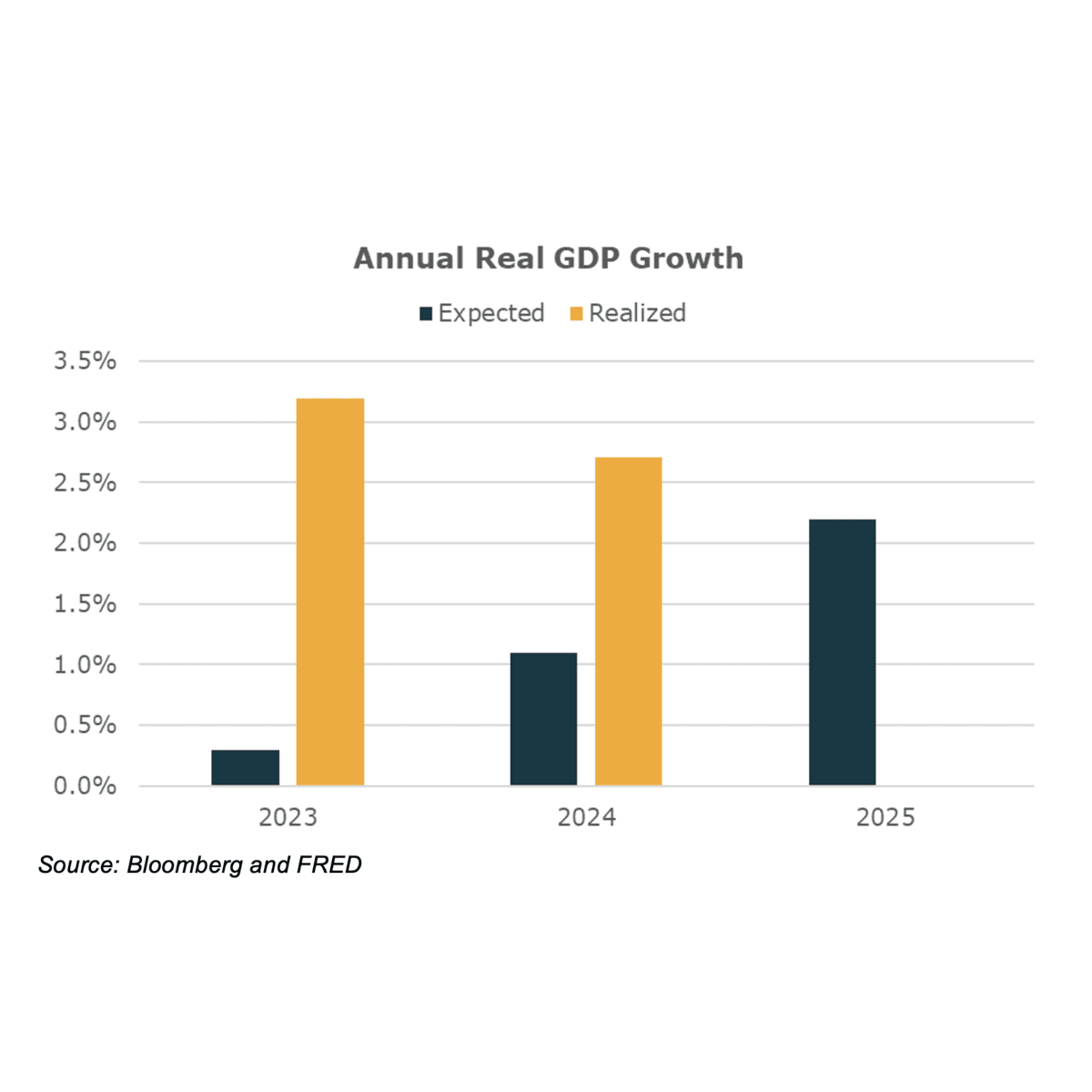

Expectations for the US economy coming into a new year have not been this high in quite some time and Asset markets have fully priced in this exuberance.

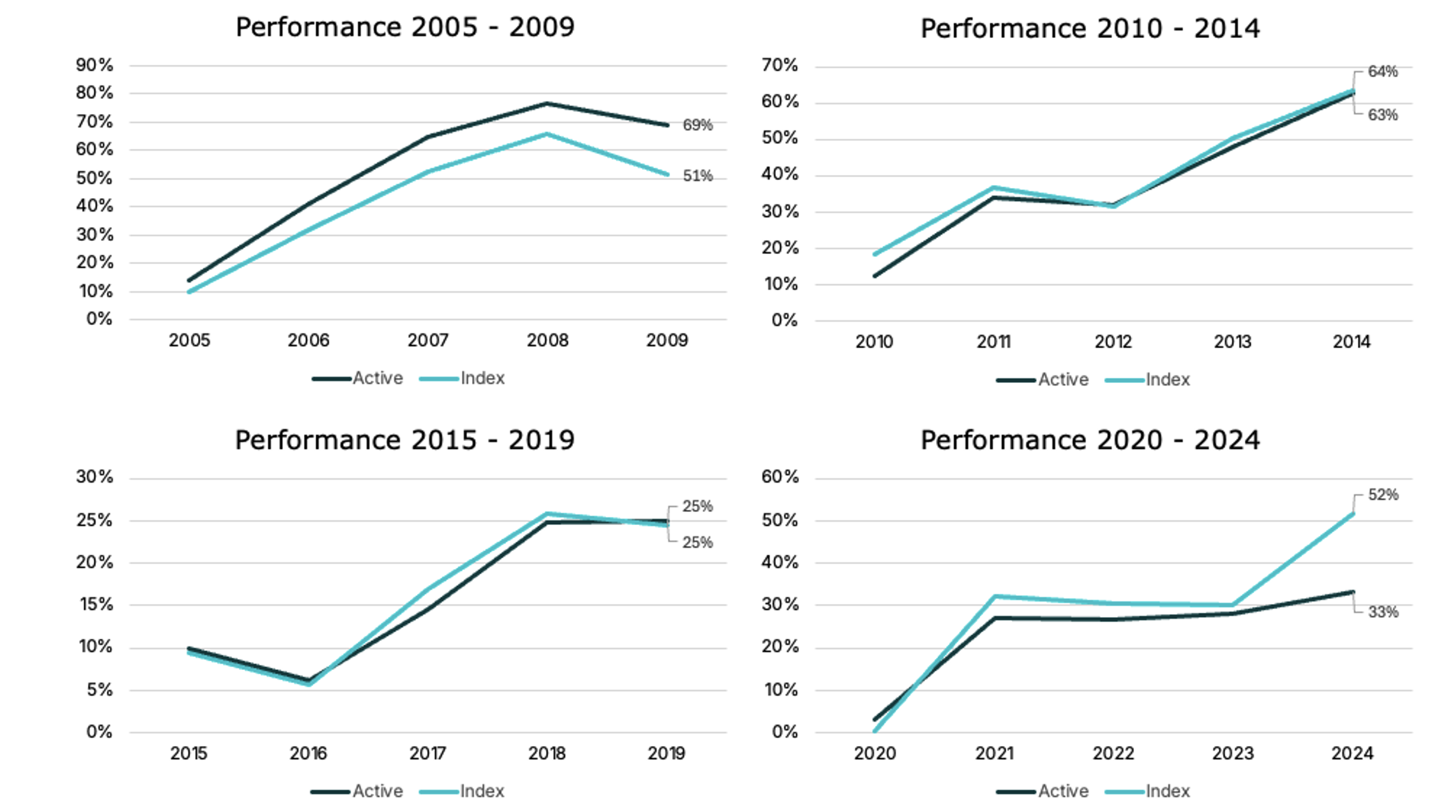

Long Time Allocators Remember When Fund Picking Worked, But It Is Possible Those Days Are In The Rearview

Published by Bob Elliott and Nathan Nangia on November 12, 2024 We’ve written several pieces about hedge fund persistence and the potential benefits of hedge

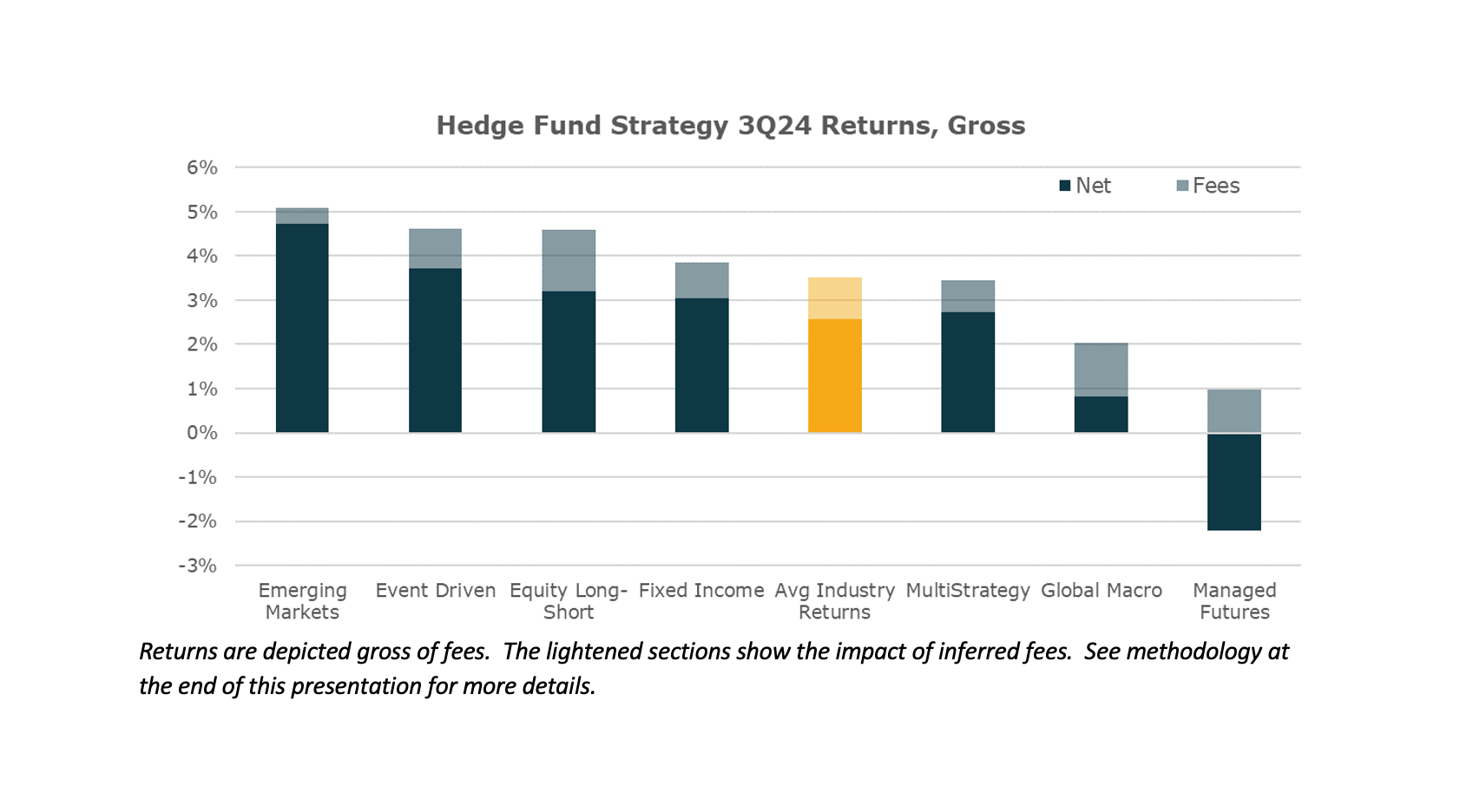

3Q 2024 Unlimited Hedge Fund Barometer

Report Highlights 3Q 2024 Hedge Fund Strategy Performance, Gross of Fees Commentary Hedge Fund performance in the third quarter was moderately positive, with Emerging Markets

Indexing Can Outperform Searching For Tail Risk Alpha

As this cycle becomes long in the tooth, many allocators are evaluating whether their portfolios may be underweight managers that perform well during turbulent market environments.

Elusive Persistence

Last year, we wrote a piece evaluating hedge funds’ performance persistence and its implications on allocators’ ability to select managers. Our conclusion was straightforward: individual hedge fund manager outperformance is not persistent relative to the overall Hedge Fund index. Therefore, a randomly selected portfolio of funds would perform as well as an allocators’.

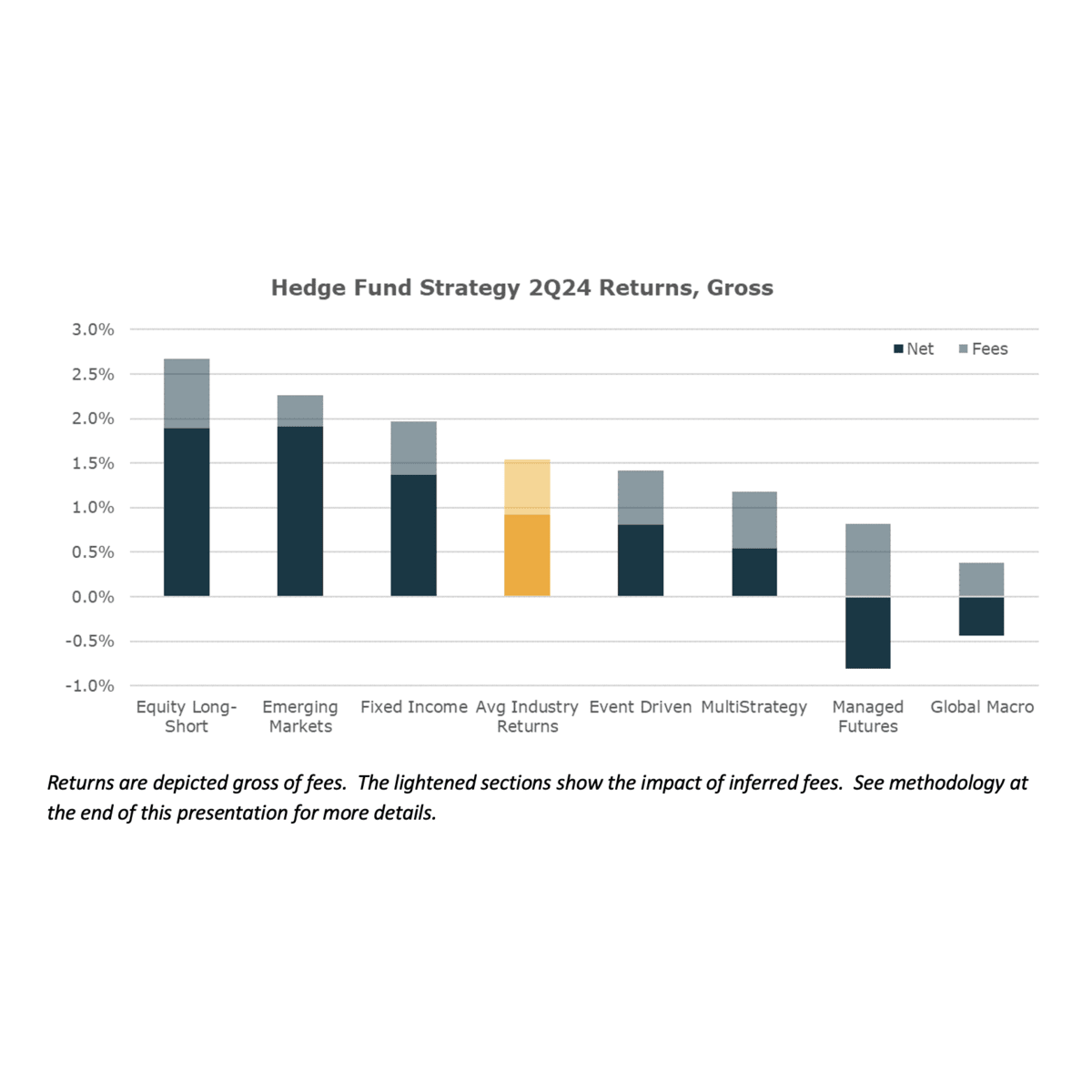

2Q 2024 Unlimited Hedge Fund Barometer

Hedge Fund performance in the second quarter was modestly positive across most hedge fund strategies, with Managed Futures and Global Macro managers notably delivering weak returns as market and economic trends oscillated quickly from March to April to May.