Unlimited Blog

We are experienced investors using machine learning to create products that replicate the index returns of alternative investments.

1Q 2025 Unlimited Funds Hedge Fund Barometer

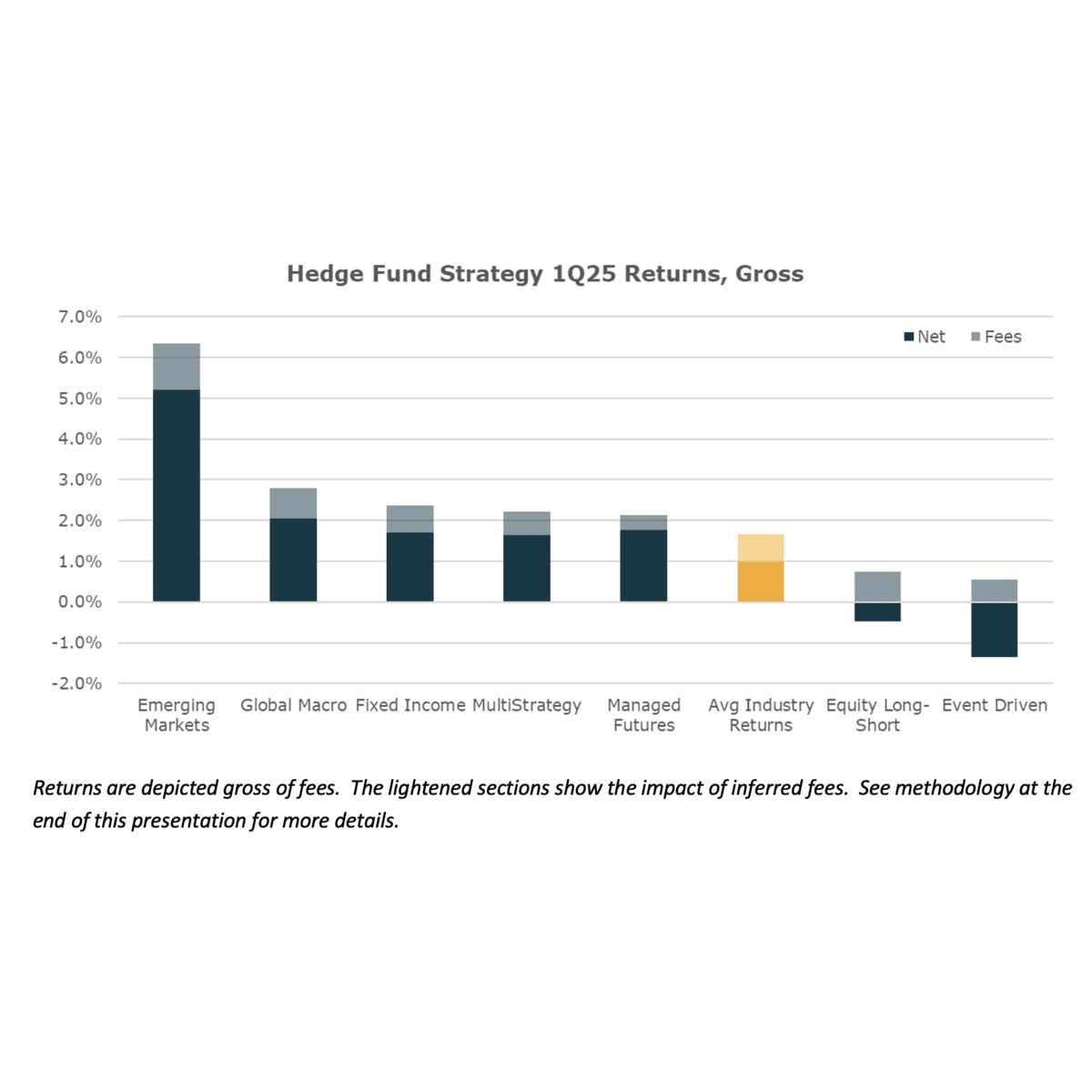

Hedge Funds eked out modestly positive performance in 1Q25 with the mix of sub-strategy returns largely reversing the moves of the previous quarter. Emerging Market funds outperformed meaningfully as Chinese stocks surged, meanwhile Equity Long/Short and Event Driven delivered weak outcomes.

Top Posts

What’s Under the Hood? What Matters for ETF Liquidity

Understanding the liquidity of an individual stock, bond, or futures contract is…

Harnessing the Wisdom of the Crowd to Mitigate Down-side Risk

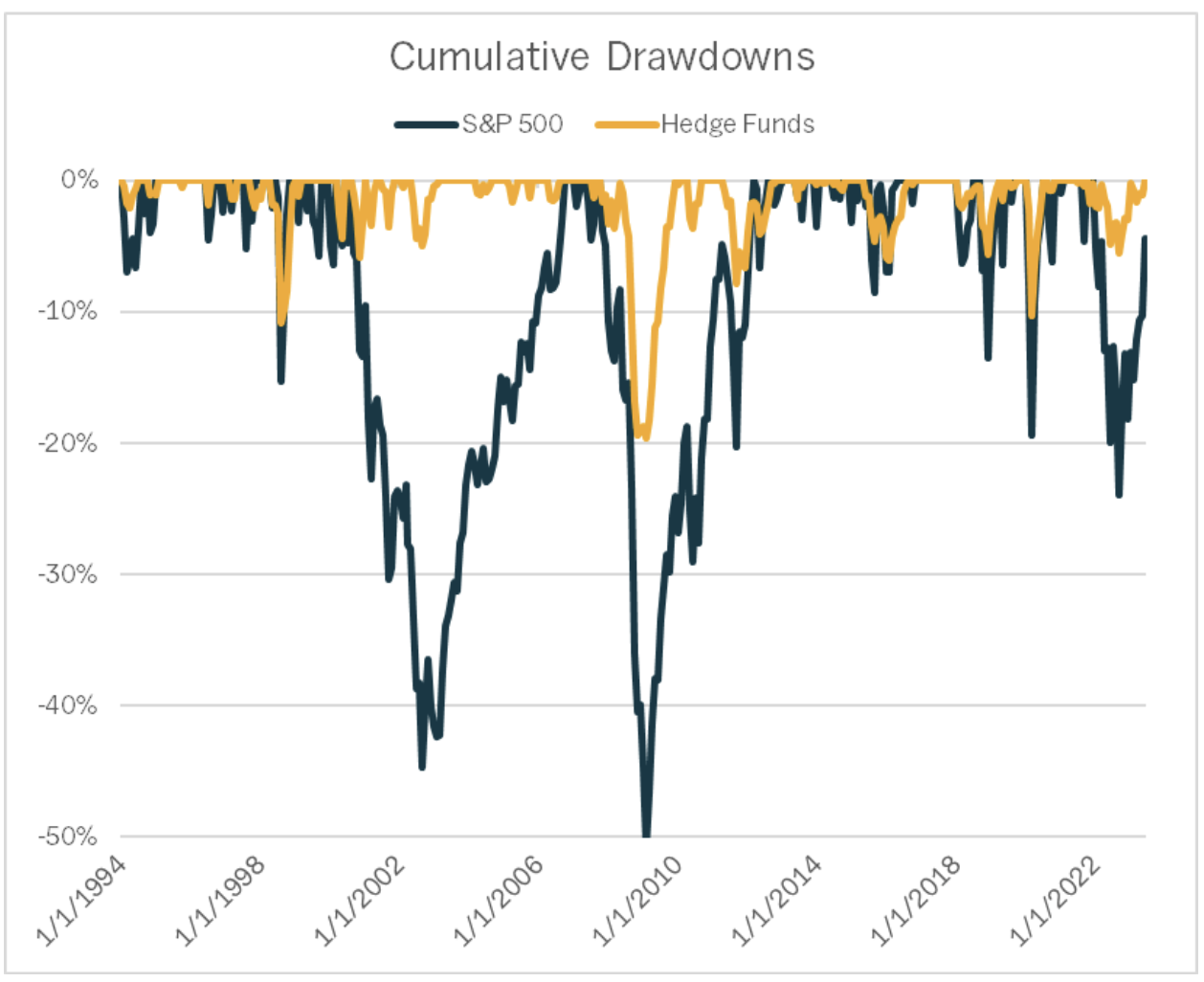

Over the past thirty years, hedge funds have proven an uncanny ability to avoid significant down-side risk in equities.

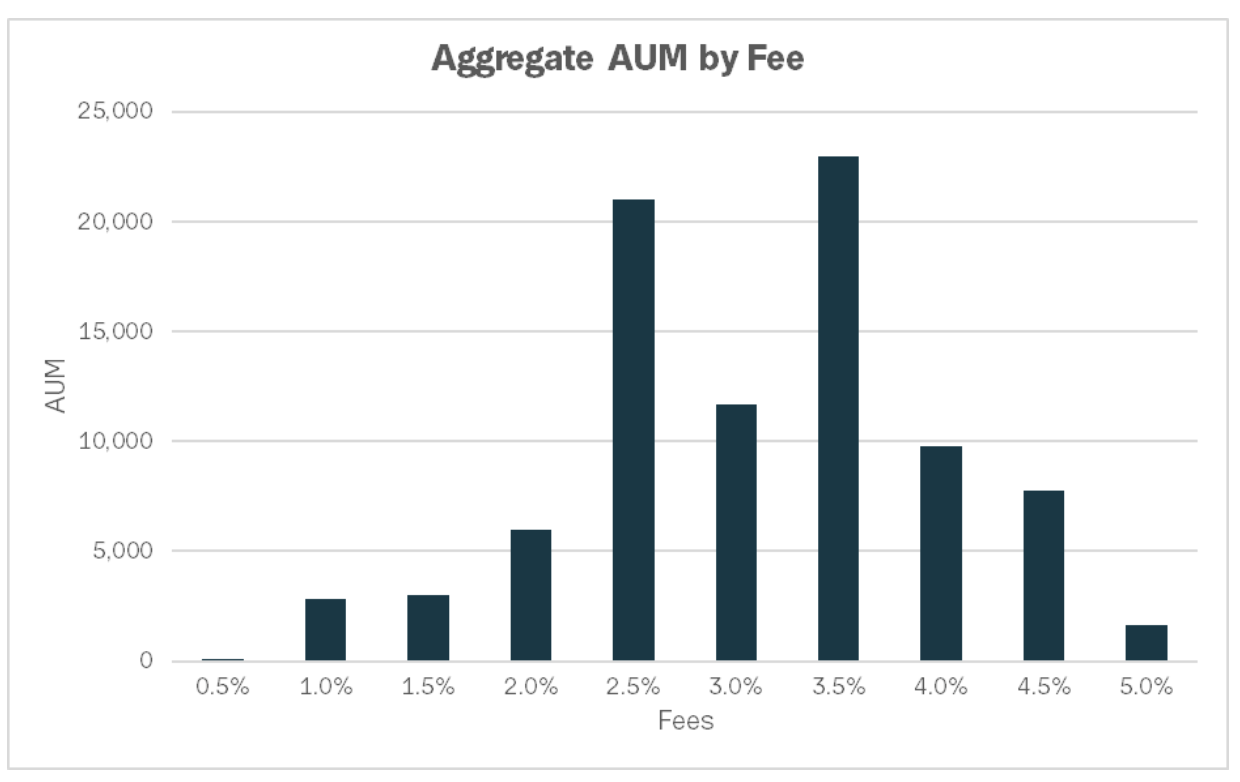

The Fees Are Too Damned High for Most Liquid Alts

Liquid alternatives products often offer the allure of returns that could benefit most…

Hedge Funds Stay Defensive As Equities Creep Higher

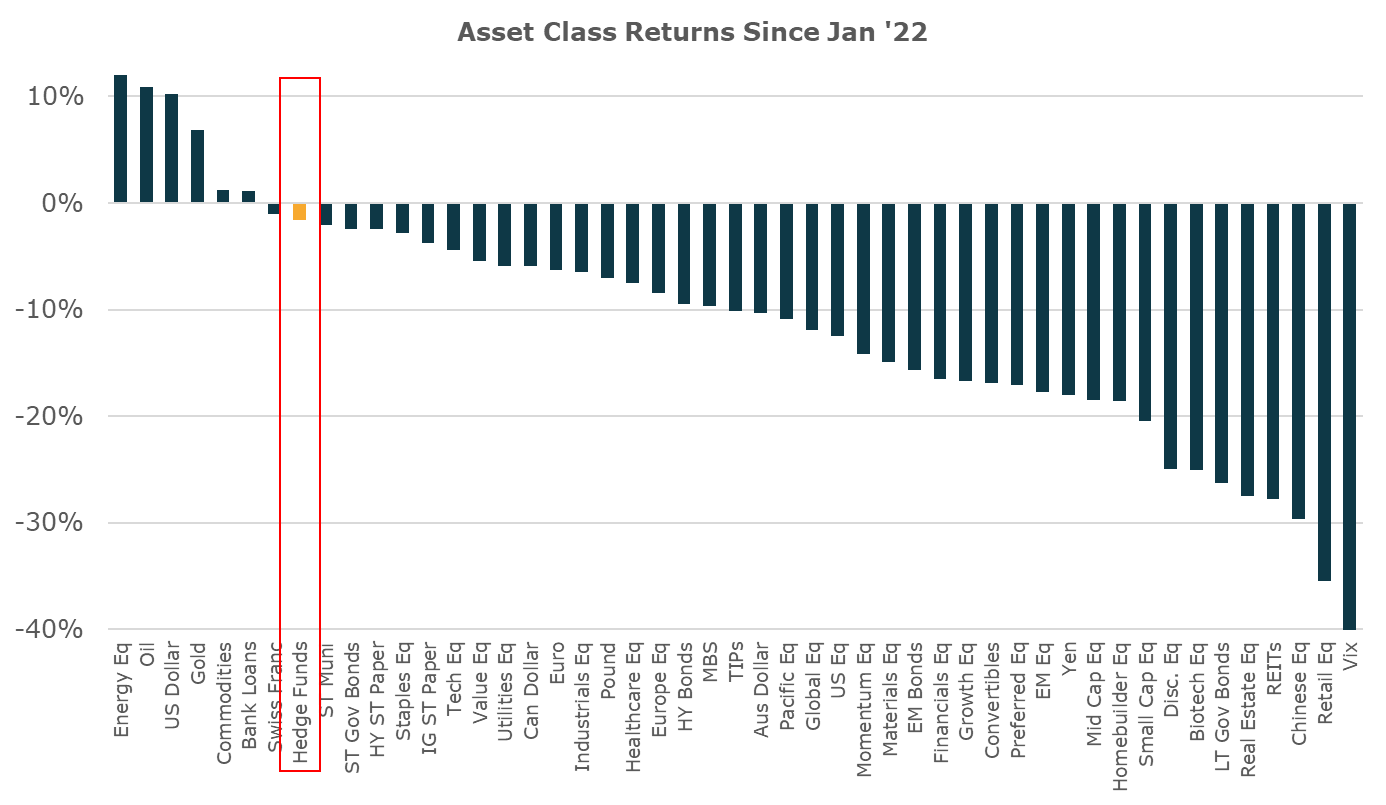

It’s been a difficult year for the Hedge Fund industry, generating mid single digit returns in an environment of very strong equity performance

Hedge Funds Cautiously Tilt Higher For Longer

The Silicon Valley Bank failure and subsequent deflationary credit crunch market dynamics created significant pain for many hedge funds…

Imperfect Replication Beats Single Manager Selection 9/10 Times

One of the commonly raised concerns about Hedge Fund replication strategies is the tracking…

Hedge Funds, What Have You Done for Me Lately? A Lot.

Hedge Funds are roughly flat in ‘23 while a broad market cap weighted index of US stocks has…

Stocks Need Easy Money to Consistently Outperform Hedge Funds

Stock indexes have outperformed hedge funds by quite a bit this year. As of late May, the NASDAQ is…

Hedge Funds Positioning For A Wide Range Of Possible Outcomes

The current macro environment presents some of the most uncertain circumstances that we have…