Unlimited Blog

We are experienced investors using machine learning to create products that replicate the index returns of alternative investments.

1Q 2025 Unlimited Funds Hedge Fund Barometer

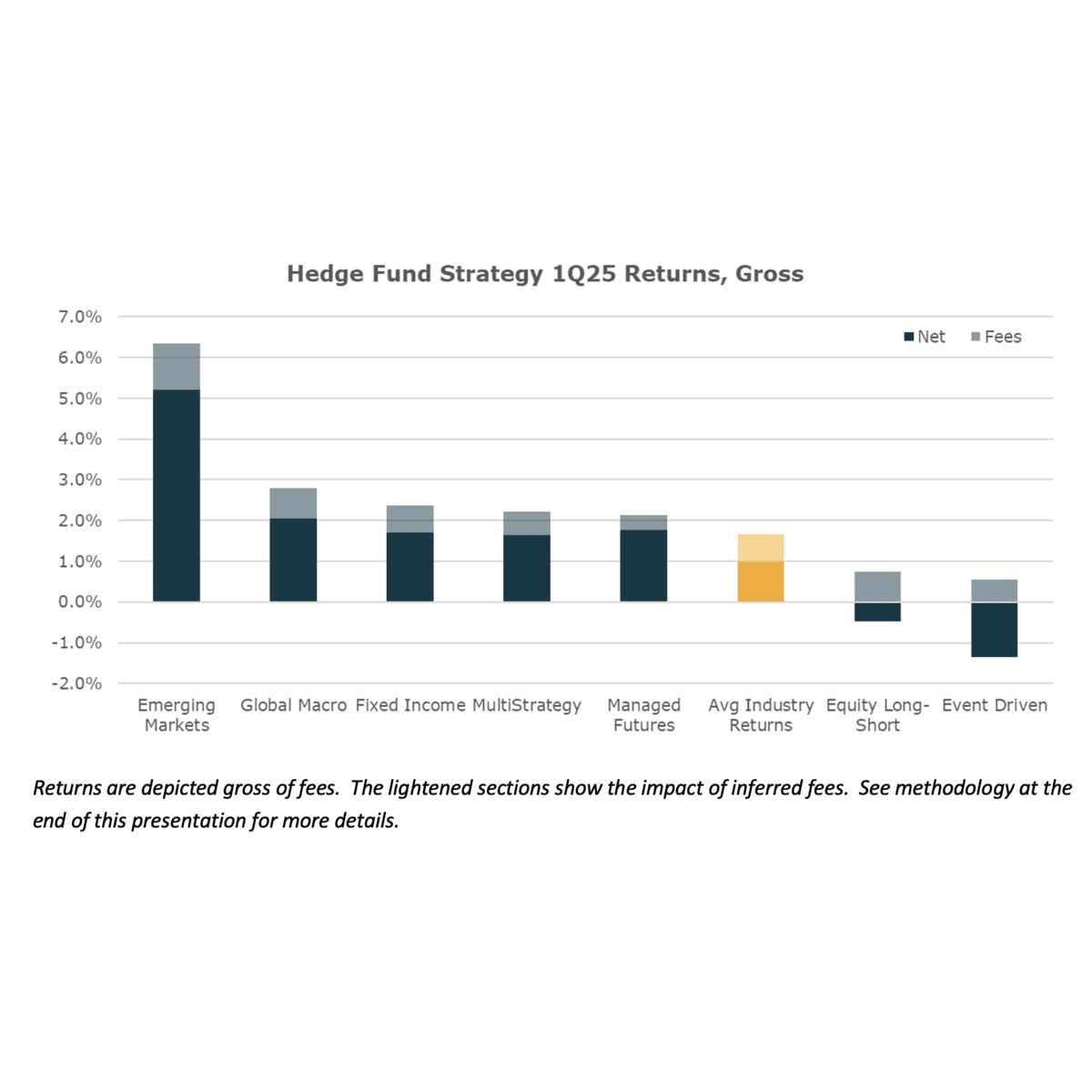

Hedge Funds eked out modestly positive performance in 1Q25 with the mix of sub-strategy returns largely reversing the moves of the previous quarter. Emerging Market funds outperformed meaningfully as Chinese stocks surged, meanwhile Equity Long/Short and Event Driven delivered weak outcomes.

Top Posts

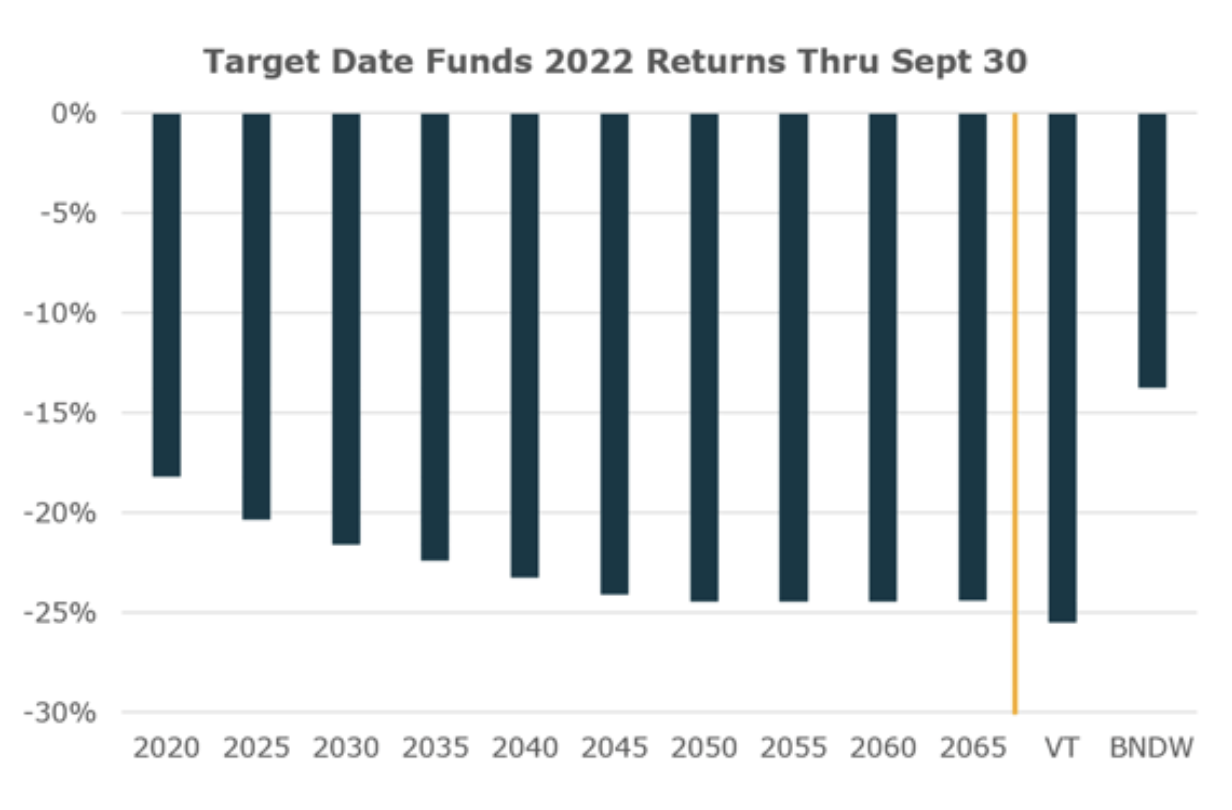

Only Stocks for The Long Run? Why Target Date Funds Suck

Target Date Funds have become the go to solution for many 401ks with nearly 4tln using these…

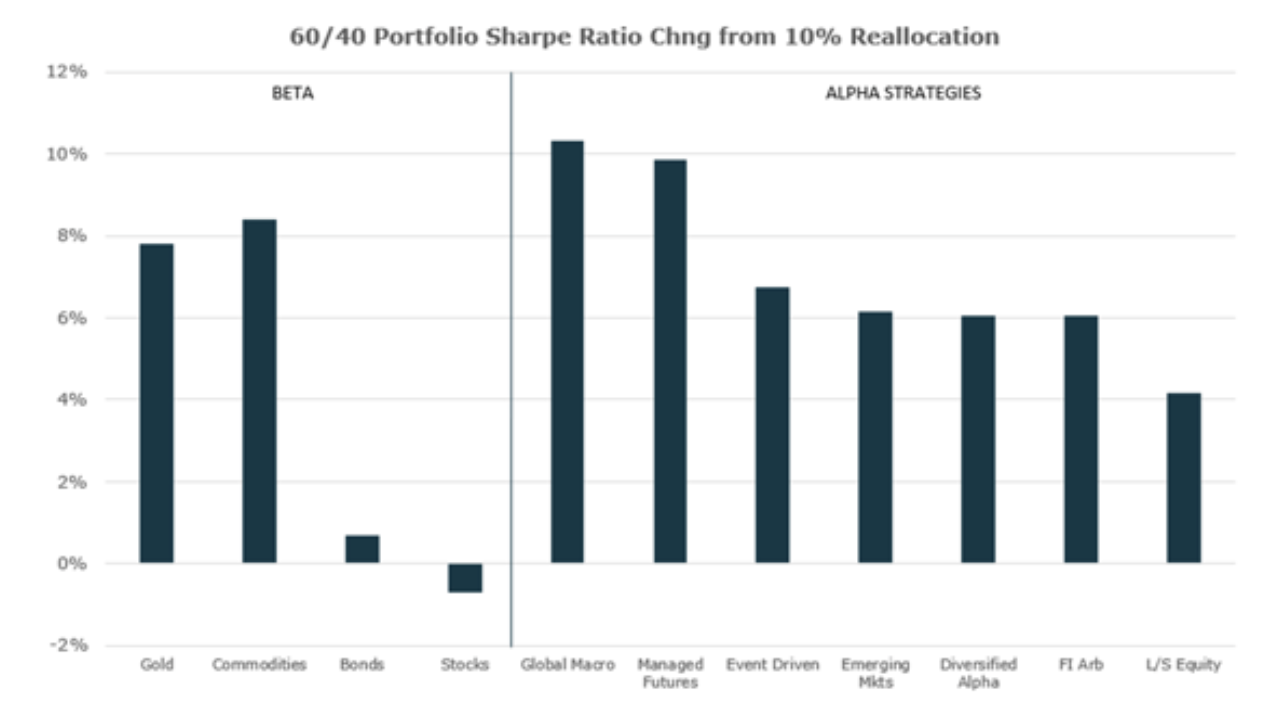

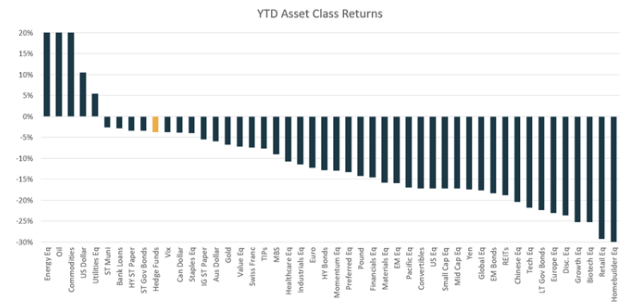

A Prime Opportunity To Improve Diversification

2022 was a difficult year for most investors and advisors. The one silver lining is that this…

Hedge Funds Are Effectively Playing Defense

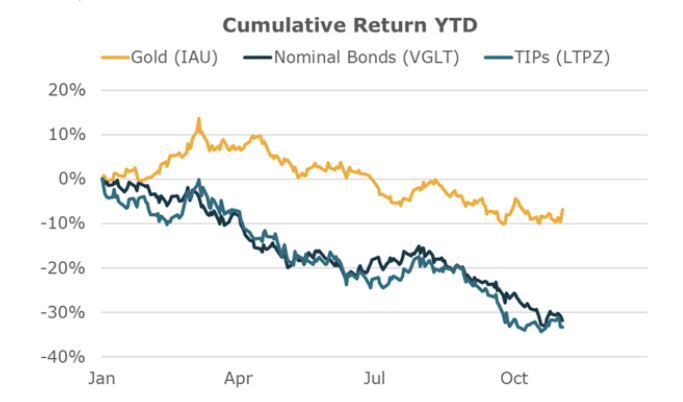

It’s been a tough year for all investors as nearly all passive asset investments have lost money except for concentrated commodity positions.

Is the U.S. Economy in a Recession? No.

Considering the widespread speculation that the economy is in a recession, we thought it might be…

The Role of Gold In a Portfolio

Gold is a unique financial asset. It is best thought of as a non-interest bearing real asset…

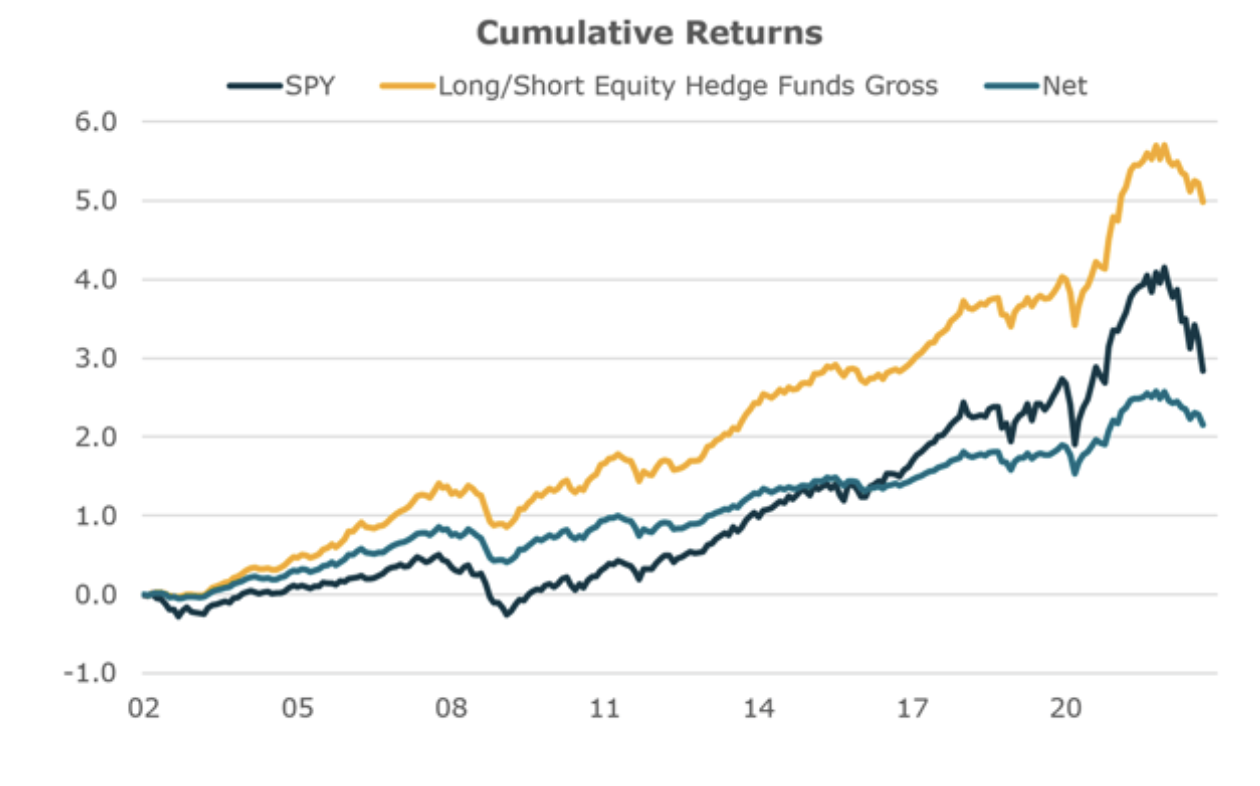

L/S Equity Has A Fee Problem, Not a Performance Problem

Long Short Equity hedge funds have taken a lot of heat in the press recently. After years of…

Hedge Funds Are Doing Pretty Well This Year

Diversified alpha allocations should deliver pretty good returns (on par with the S&P 500) with…

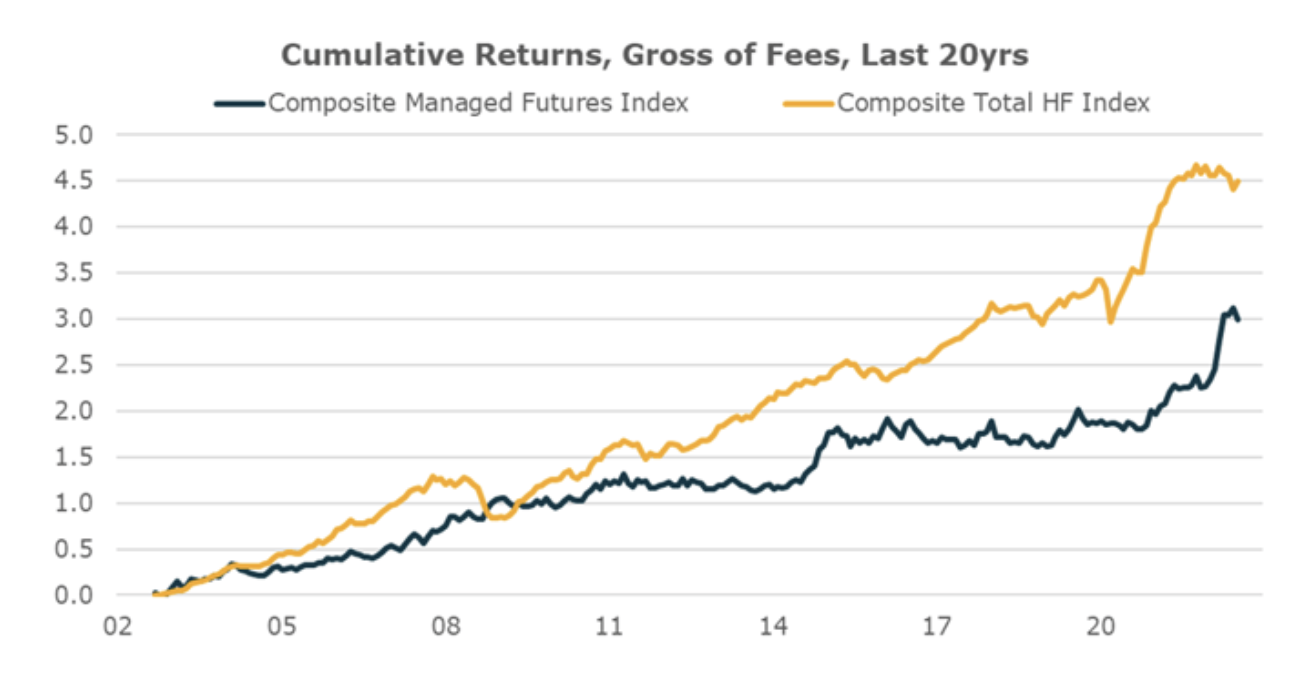

Managed Futures Have Been Good, Diversified Alpha Will Be Better

Managed Futures managers’ strong performance this year is reviving the sector after nearly…

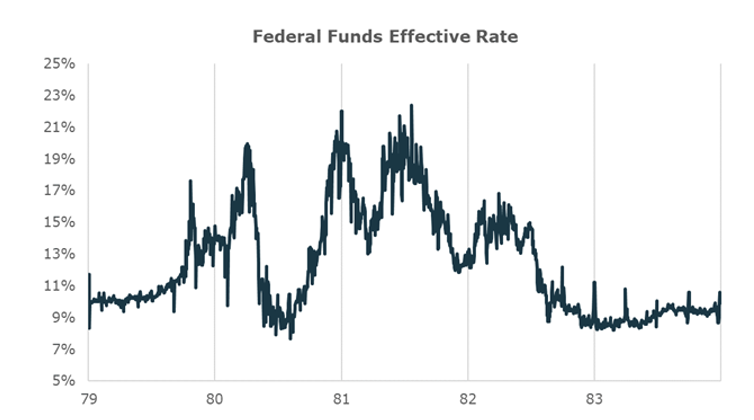

Lessons From Volcker’s Inflation Fight

All eyes are on Chairman Powell’s speech this week for his thoughts on how he will tackle today’s…