Unlimited Blog

We are experienced investors using machine learning to create products that replicate the index returns of alternative investments.

1Q 2025 Unlimited Funds Hedge Fund Barometer

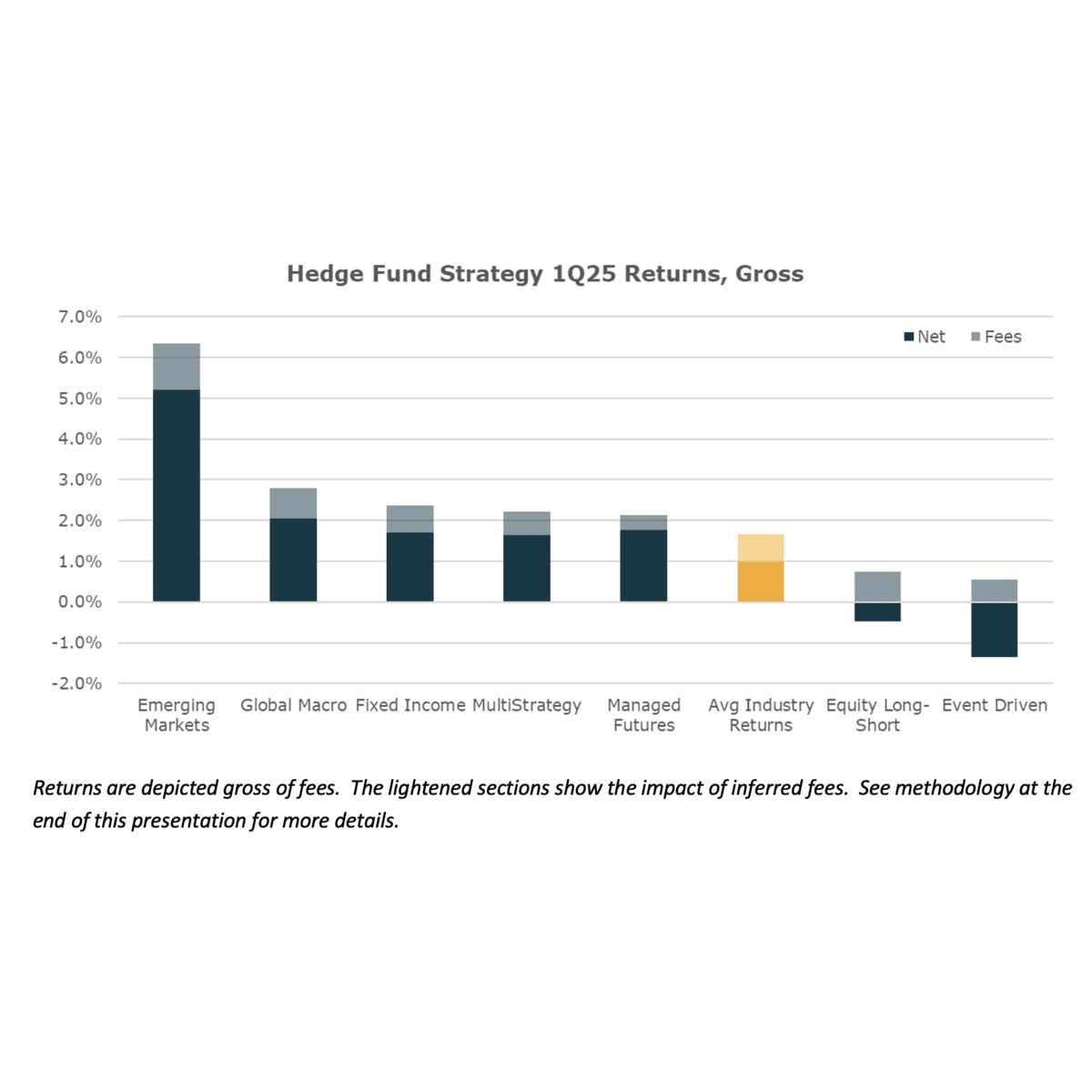

Hedge Funds eked out modestly positive performance in 1Q25 with the mix of sub-strategy returns largely reversing the moves of the previous quarter. Emerging Market funds outperformed meaningfully as Chinese stocks surged, meanwhile Equity Long/Short and Event Driven delivered weak outcomes.

Top Posts

Diversified Alpha is Better Than Constrained Beta

Investors are always looking for a way to reduce their risk while preserving upside. That’s why..

Pain Before Pivot

In early 2010 financial markets were pricing in that the improvement in conditions would allow the…

The Futility of Chasing Outperforming Hedge Fund Styles

In early 2010 financial markets were pricing in that the improvement in conditions would allow the…

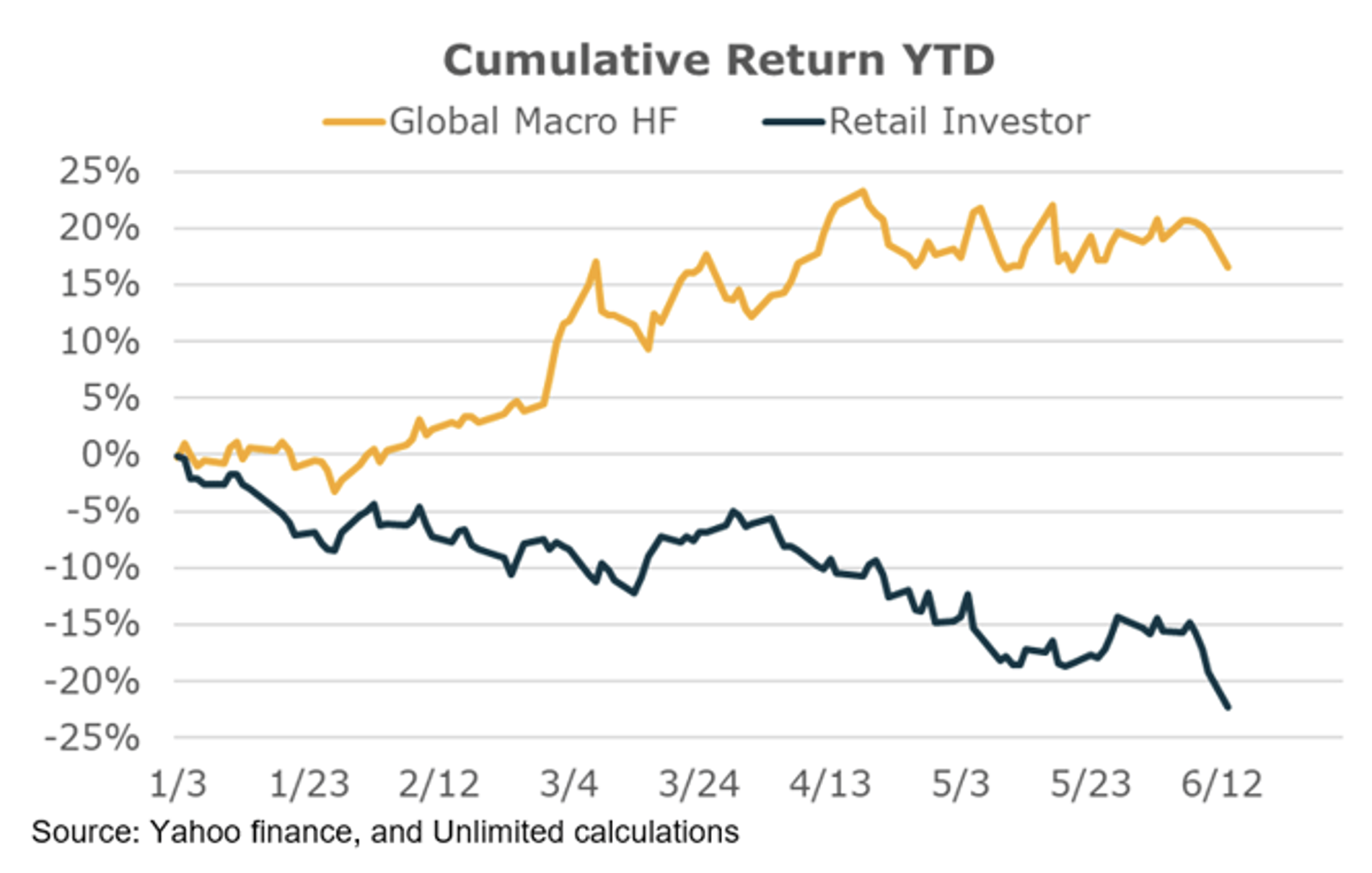

Macro Managers Are The “Smart Money” During Volatile Times

Global Macro funds are having one of their best years ever. Retail investors are having one of…

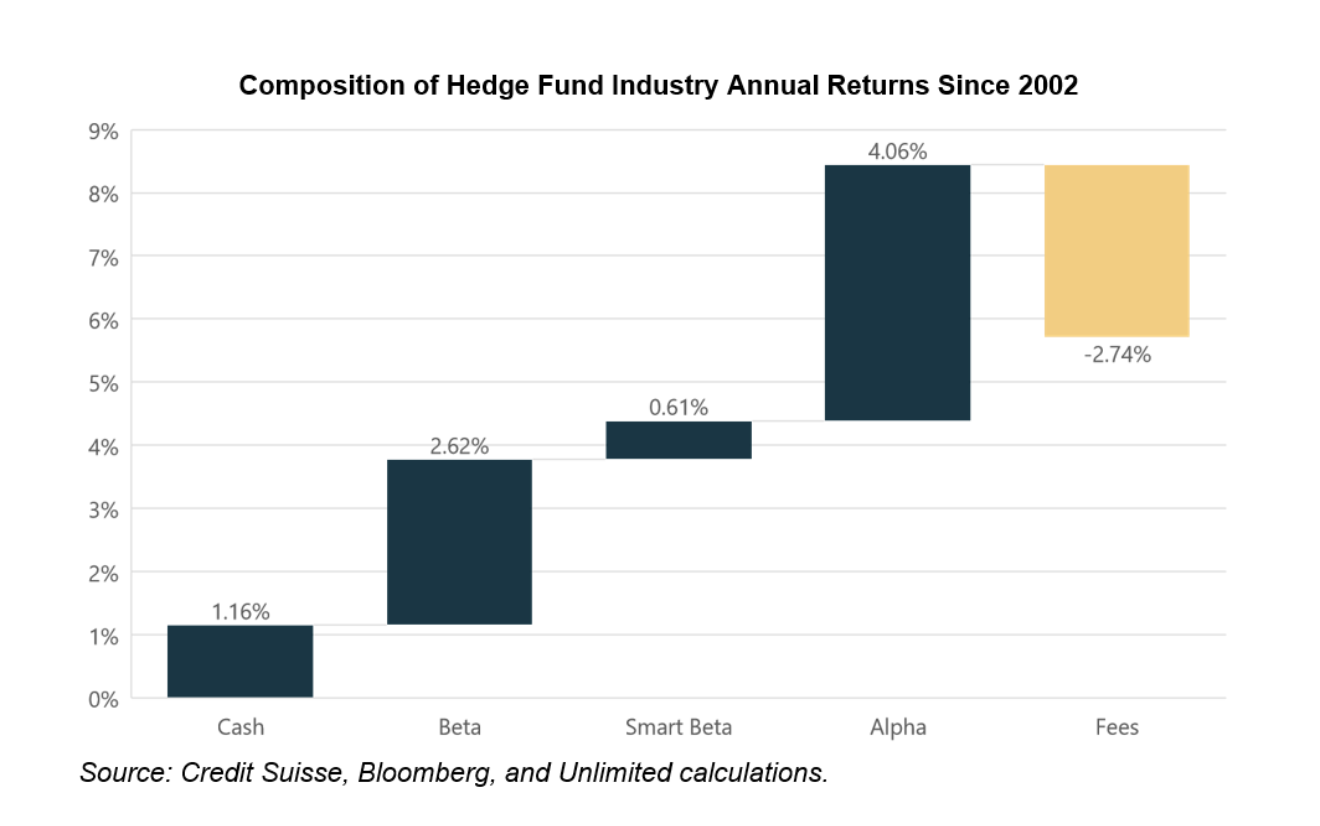

Where Does All The Hedge Fund Alpha Go?

The vast majority ends up in managers’ pockets. No wonder they have so many yachts. For years…

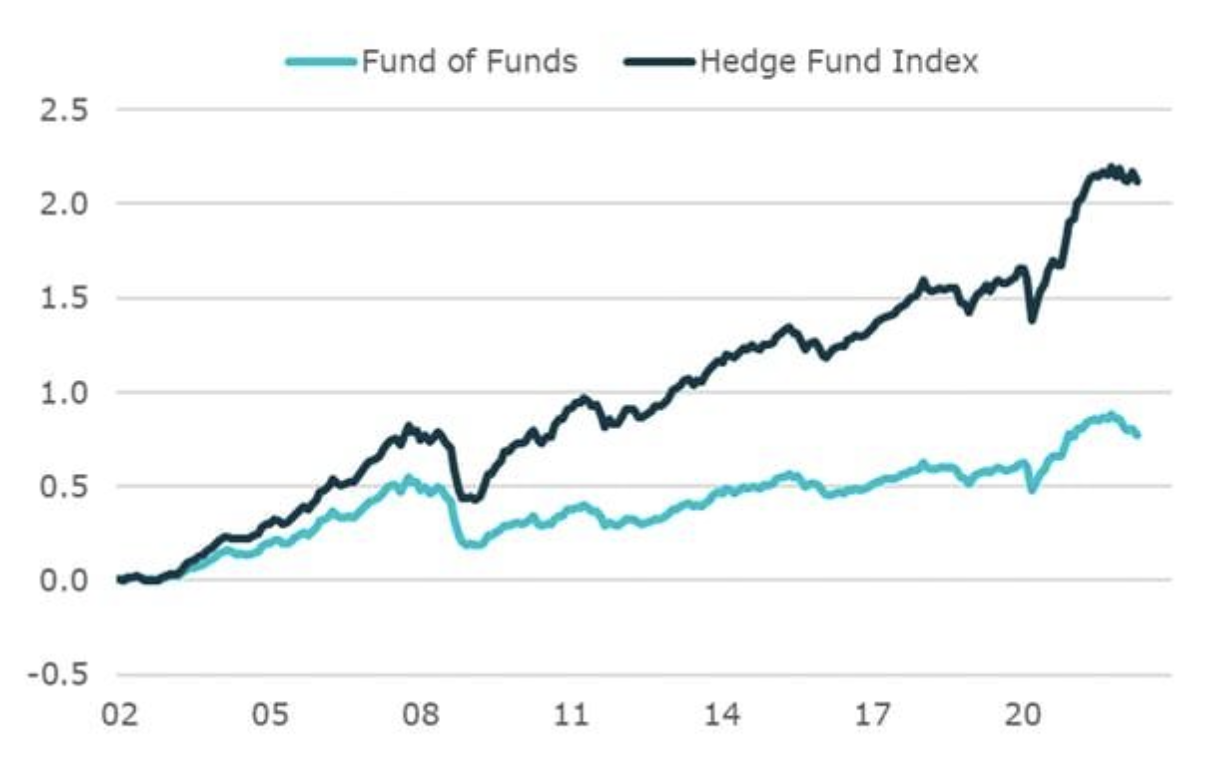

Can Funds of Funds Consistently Pick Winners?

Investors who want diversified hedge fund exposure often look to Funds of Funds (FoF) investments…

Hedge Funds Outperform During Recessions

During recessionary periods, it’s much better to hold hedge funds than it is to have a traditional 60/40 mix..

Repeating Bogle’s Folly with Hedge Funds

Low cost index funds yield better returns than a portfolio of high cost managers. What was seen…

Cover In A Storm

It has been a difficult year for most investors. Most major liquid asset classes are down.